- Arbitration

- Banking & Finance

- Capital Markets

- Commercial

- Competition

- Construction & Infrastructure

- Corporate / Mergers & Acquisitions

- Corporate Services

- Corporate Structuring

- Digital & Data

- Dispute Resolution

- Employment & Incentives

- Family Business & Private Wealth

- Innovation, Patents & Industrial Property (3IP)

- Insurance

Find a Lawyer

Book an appointment with us, or search the directory to find the right lawyer for you directly through the app.

Find out more

The Technology Issue

Decoding the future of law

This Technology Issue explores how digital transformation is reshaping legal frameworks across the region. From AI and data governance to IP, cybersecurity, and sector-specific innovation, our lawyers examine the fast-evolving regulatory landscape and its impact on businesses today.

Introduced by David Yates, Partner and Head of Technology, this edition offers concise insights to help you navigate an increasingly digital era.

2025 is set to be a game-changer for the MENA region, with legal and regulatory shifts from 2024 continuing to reshape its economic landscape. Saudi Arabia, the UAE, Egypt, Iraq, Qatar, and Bahrain are all implementing groundbreaking reforms in sustainable financing, investment laws, labor regulations, and dispute resolution. As the region positions itself for deeper global integration, businesses must adapt to a rapidly evolving legal environment.

Our Eyes on 2025 publication provides essential insights and practical guidance on the key legal updates shaping the year ahead—equipping you with the knowledge to stay ahead in this dynamic market.

The leading law firm in the Middle East & North Africa region.

A complete spectrum of legal services across jurisdictions in the Middle East & North Africa.

-

Practices

- All Practices

- Banking & Finance

- Capital Markets

- Commercial

- Competition

- Construction & Infrastructure

- Corporate / Mergers & Acquisitions

- Corporate Services

- Corporate Structuring

-

Sectors

-

Country Groups

-

Client Solutions

Today's news and tomorrow's trends from around the region.

17 offices across the Middle East & North Africa.

Our Services

Back

Back

-

Practices

- All Practices

- Banking & Finance

- Capital Markets

- Commercial

- Competition

- Construction & Infrastructure

- Corporate / Mergers & Acquisitions

- Corporate Services

- Corporate Structuring

- Digital & Data

- Dispute Resolution

- Employment & Incentives

- Family Business & Private Wealth

- Innovation, Patents & Industrial Property (3IP)

- Insurance

- Intellectual Property

- Legislative Drafting

- Private Client Services

- Private Equity

- Private Notary

- Projects

- Real Estate

- Regulatory

- Tax

- Turnaround, Restructuring & Insolvency

- Compliance, Investigations & International Cooperation

-

Sectors

-

Country Groups

-

Client Solutions

- Law Firm

- /

- Insights

- /

- Law Update

- /

- June – July 2018

- /

- Overhaul of the UAE Finance Companies Regulations

Overhaul of the UAE Finance Companies Regulations

Maymoona Talib (Mandviwala) - Associate - Banking and Finance

Amongst the several new laws and regulations being introduced in the UAE, the UAE Central Bank (“Central Bank”) has on10 May 2018 issued new Finance Company Regulations (“Regulations” or “2018 Regulations”) which are to come into effect one month after its publication.

These Regulations replace the previous finance company regulations issued in 1996 and finance companies regulations for companies conducting business as per Islamic sharia’a principles issued in 2004 (“Previous Regulations”) and aim at providing a detailed regulatory framework for Finance Companies to operate and develop within the UAE and also covers in its ambit the framework for protecting the customers of such Finance Companies.

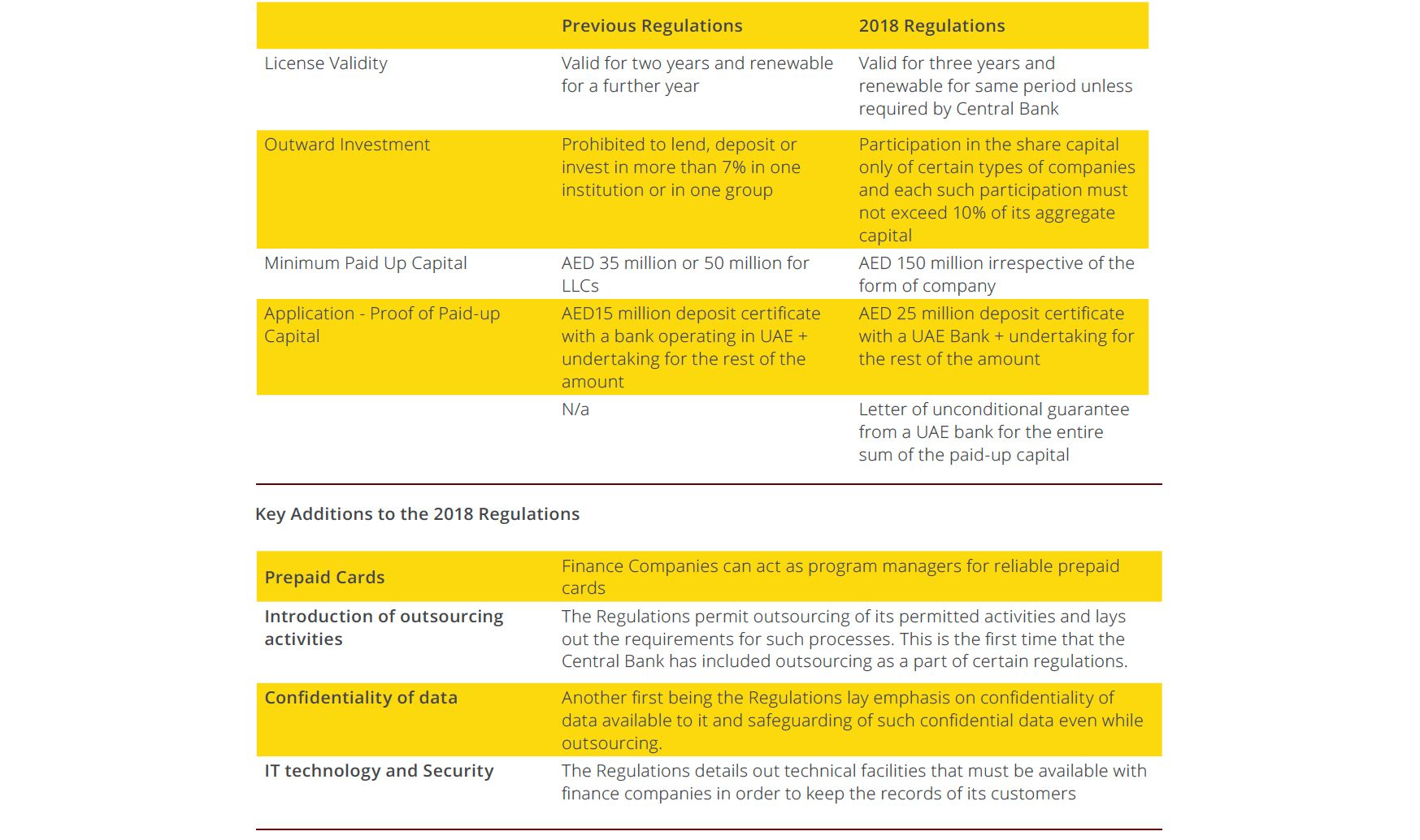

These Regulations consolidate the regulations for both Islamic finance and conventional finance companies (“Finance Company/ies”) and incorporate certain significant changes including changes to capital requirements and corporate governance, to also be followed by existing Finance Companies. We have set out below certain noteworthy features of these Regulations and a comparative table on the key changes from the Previous Regulations on subject.

License Application

Pursuant to these Regulations, conducting financing activities in the UAE without a central bank license is prohibited. An application for such license must include the proposed scope of activities, a feasibility study illustrating the financial activities and products to be launched, estimated financial projections, risk factors, corporate structure, start-up costs, branches and a recruitment plan.

Another important requisite is for the applicant to provide an unconditional guarantee from a UAE Bank, in favour of the Central Bank for an amount equivalent to the minimum required paid-up capital. The License will be granted for a period of three years and may be renewable for the same period unless otherwise required by the Central Bank.

Any changes to the ownership of the Finance Company of 5% or more will require prior approval from the Central Bank.

Cancelling or Revoking a License

The Central Bank has the discretion to approve or refuse the License application, but must notify applicants in writing with reasons in case there is a refusal. Licenses can also be amended, revoked or cancelled at the discretion of the Board. The Regulations set out instances when the license can be cancelled which include providing false/misleading information, risking interests of the potential customers, or if there is a bankruptcy order filed against the Finance Company.

If a Finance Company wishes to cease operations it must apply to the Central Bank at least six months in advance providing the reasons for such a cessation or suspension.

The Regulations also provide for penalties that will be imposed if such company does not follow the provisions of the Regulations including adhering to the anti-money laundering policies laid down by the Central Bank.

Permitted Activities

Article 10.1 of the Regulation details out the types of activities that are permitted, which are:

- Retail finance,

- mortgage finance,

- wholesale finance,

- pre-paid cards, and

- distribution of third party products.

The Central Bank can review and amend this list from time to time.

Article 10 further sets out the do’s and dont’s in relation to the business of the Finance Company, certain key features are:

- it can extend loans only to ‘Juridicial Persons’ (defined under Article 93 of the UAE Civil Transactions Law) and individuals in the UAE. However, it is prohibited from accepting deposits or loans from individuals.

- it may accept deposits only from Juridicial Persons, subject to certain conditions laid out under Article 10.4 and also borrow from UAE banks, and may even receive foreign funding provided that its risk has been adequately hedged. In doing so it must not exceed 25% of the sum of total amount of its debt capital.

- it must obtain a no objection letter from the Central Bank in order to provide any new product line from within activities specified in its license.

- it may only participate in the share capital of brokerage companies, money exchanges, UAE banks and other Finance Companies. Any such single participation cannot exceed 10% of its debt capital and the aggregate participation must not exceed 25% of the debt capital.

- It must obtain approval from the Central Bank in order to issue bonds or sukuks. Such bonds and sukuks shall only be denominated in UAE dirhams or US Dollars.

- it is prohibited from financing a borrower which is not an entity incorporated in the UAE or its free zones, or a UAE resident, or where the mortgaged assets are not in the UAE.

- it is prohibited from entering into the business of money exchange.

- it must not purchase immovable properties unless for its own use or specific approval for the same has been obtained from the Central Bank. This rule does not apply to Islamic Finance Companies (IFC). IFCs may own property including immovable property and goods as part of an underlying financing contract with a borrower.

Minimum Capital, Liquidity Requirements and Credit Exposure Restrictions

The minimum paid-up capital for a Finance Company is 150 million UAE Dirhams. UAE national ownership of the Finance Company must comprise at least 60% of total paid-up capital. Finance Companies must also allocate at least 10% of annual net profits to establishing a statutory reserve until the reserve equals 50% of its paid-up capital.

To withstand short-term liquidity stress, Finance Companies are required to hold an amount equivalent to 10% of their aggregate liabilities in liquid assets i.e. cash held in UAE bank, Certificates of deposit issued by the Central Bank held via a UAE bank, short term deposits with a UAE bank with maturity upto 30 days and UAE federal and local government bonds, which must not exceed 30% of the total liquid assets. For the purpose of calculating the 10% amount, a Finance Company may deduct from its aggregate liabilities, cash collateral, bank guarantees from UAE banks and sovereign guarantees.

The credit exposure is considered ‘large’ if the value of such exposure to one borrower or group of related entities is 7% or more. The Regulations set out maximum exposure limits for different borrower types.

Organisational Structure, Composition and Policies of the Finance Company

- Founding shareholders – Founding shareholders must satisfy “Fit and Proper” criteria as defined by the Central Bank and their appointment must be in line with the Commercial Companies Law.

- Board of Directors – The board of directors of a Finance Company must have no fewer than five members. Atleast 60% of the board members of an IFC must have knowledge of the banking business or Islamic finance and banking business as the case may be. The Regulations provide for detailed selection processes and guidances in relation to the board of directors

- Sharia’a Supervision Committee and other committees – An IFC must have a Sharia’a Supervision Committee, and its role must be laid out in the policies of the IFC. Finance Companies must also have a board committee and credit committee.

- Senior Management – Finance Companies must comply with the ‘fit and proper‘ test set out by the Central Bank and must be professional who understands the business of finance and was experience of not less than 10 years in the field of finance. Person within the senior management cannot be a part of the board.

- Corporate Governance – While the Regulations set out certain minimum requirements for corporate governance, Finance Companies are permitted to set out their own policies and framework for corporate governance (complying with the Regulations), however these must be approved by its board of directors and a copy of such policies must be provided to the Central Bank.

- Internal Policies – the Regulations set out the requirements that need to be adhered to by Finance Companies and IFC with respect to its internal polices in relation to management, risk management, extension of credit, compliance, information technology, security, audit, remuneration, outsourcing, etc.

Other provisions

- Consumer Protection: the Name of the finance company must not include the words “bank”, “investment company” or and other term which may mislead its customer. It must provide its customers with sufficient information regarding its products, etc. in order for them to be able to make an informed decision. The Finance Company must follow the Central Bank guidelines in relation to ‘Consumer Protection’.

- Credit Reports – Every Finance Company must adhere to the credit reporting requirements of the Al Etihad Credit Bureau and other credit agencies to provide to and obtain information of the Borrower.

- Accounting Standards – A Finance Company must implement all applicable International Accounting Standards/International Financial Reporting Standards and provide the Central Bank with two copies of signed audited financial statements, including external auditor reports, before 31st March every year. The Central Bank may require the Finance Company to appoint another auditor if the size and nature of the business of the Finance Company so requires.

Differences in the new Regulations from the Previous Regulations

The 2018 Regulations are far more detailed in the nature of investments permitted, liquidity requirements, organisational structure to be followed, investor guidance; we have set out below certain differences in the provisions between the Previous Regulations and 2018 Regulations.

These Regulations apply to all Finance Companies. Accordingly companies licensed prior to the date of the issuance of these Regulations need to comply with the 2018 Regulations and are given a period not exceeding 3 years from the publication to conform. However, the Central Bank may amend the requirement of compliance within 3 years if it deems the finance company to be substantially in compliance with these Regulations. All existing Finance Companies will require to provide the Central Bank with a detailed adjustment plan to comply with the articles of these Regulations.

Al Tamimi & Company’s Banking and Finance team regularly advises on the Finance Company Regulations. For further information please contact Mark Brown (m.brown@tamimi.com) or Maymoona Talib (m.talib@tamimi.com).

Stay updated

To learn more about our services and get the latest legal insights from across the Middle East and North Africa region, click on the link below.