Property funds in the UAE: available options and key considerations

Malek Al Rifai - Partner - Real Estate / Sustainability focused Corporate Governance / Sustainable Finance / Sustainable Business / Sustainable Sourcing / Climate Change & Energy Transition

Dennis Ryan - Senior Associate - Banking and Finance / Venture Capital and Emerging Companies

![]() Property funds are a type of collective investment fund that invest primarily in real estate and real estate-related assets. These funds provide an easy way to obtain income from property without the need to buy the property itself. For sponsors, property funds give them access to a dedicated pool of capital to fund their real estate investments without having to raise capital on a deal-by-deal basis.

Property funds are a type of collective investment fund that invest primarily in real estate and real estate-related assets. These funds provide an easy way to obtain income from property without the need to buy the property itself. For sponsors, property funds give them access to a dedicated pool of capital to fund their real estate investments without having to raise capital on a deal-by-deal basis.

This article discusses the available jurisdictions for the establishment of property funds in the United Arab Emirates (‘UAE’). It then sets out the key considerations that sponsors should bear in mind when navigating the legal and regulatory complexities of launching the same.

The choice of jurisdictions in the UAE

Property funds can be established in the UAE in accordance with local Federal laws, or offshore under the common law adopted by either of the following UAE financial free zones, being: (i) the Dubai International Financial Centre (‘DIFC’); and (ii) the Abu Dhabi Global Market (‘ADGM’) (collectively, the ‘Jurisdiction(s)’). We set out below a summary of the offering that each of these Jurisdictions provide to the sponsors of property funds:

UAE onshore

The fund regime onshore in the UAE is regulated by the UAE Securities and Commodities Authority (‘SCA’) pursuant to its Administrative Decision No. (6/R.T.) of 2019 Concerning Real Estate Investment Fund Controls (the ‘UAE REIT Regulations’) read with Chairman Decision No. (9/R.M) of 2016 Concerning the Regulations as to Investment Funds and Administrative Decision No. (63/R.T) of 2019 Concerning Evaluation of In-Kind Shares of Investment Funds.

SCA has to date not issued regulations that concern property funds in general but has instead concentrated on REITs which are a subset of property funds. The main regulatory elements of a REIT under the applicable SCA Regulations are as follows:

- a REIT can be either a public or private fund. If established as private, it can be converted to public in the future;

- a REIT may borrow no more than (50 per cent) of its total assets’ value from a bank licensed to operate in the UAE;

- a private REIT must be established to invest at least 75 per cent of its assets in real estate assets for construction, development or re-fitting in preparation for sale, management, leasing or disposal;

- a REIT may establish or own one or more real estate services companies, provided that its investment in the ownership of such company and its subsidiaries shall not be more than 20 per cent of the REIT’s total assets;

- the fund documents needed to establish the REIT must be in Arabic;

- a public REIT must:

- have 75 per cent of its total assets be revenue generating real estate assets;

- receive at least 90 per cent of its total revenue from real estate interests, dividends and capital earnings relating to such income generating real estate properties;

- have equal to or less than 25 per cent of the net assets of the fund as investments in usufructuary rights, for which the remaining period is less than 30 years; and

- distribute 80 per cent of its net profits to its unit holders, every year.

REITs established pursuant to the SCA regime may be listed on a local financial market such as the Dubai Financial Market. The option to list on a local financial market provides the potential for greater access to liquidity. However, it should be noted that there is, at present, no precedent for a SCA governed public REIT listing on the Dubai Financial Market.

1. DIFC

The DIFC is a purpose-built financial free-zone, located within the Emirate of Dubai. Collective investment funds (including property funds) operating in the DIFC are regulated by the Dubai Financial Services Authority (‘DFSA’), The DFSA regulations for collective investment funds are compliant with the principles of the International Organization of Securities Commissions (‘IOSCO’) satisfying its objective to meet international standards for regulation and, where required, to provide adequate investor protection.

The DIFC was the first of the Jurisdictions to implement its funds regime in 2006 and as such represents a well-established and tested regulatory environment. Some of the features of the DFSA funds regime that make it attractive to sponsors hoping to set up in Dubai are set out below:

- a public fund regime, that offers protection to retail investors through greater regulatory oversight;

- an exempt fund and qualified investor fund that provides a fast-track notification process with significantly fewer regulatory requirements than a public fund;

- DFSA-licensed fund managers that can manage funds in both the DIFC and in jurisdictions outside the DIFC;

- external fund managers from other IOSCO member regulatory regimes are able to establish and manage funds in the DIFC by satisfying certain criteria;

- bespoke Sharia governance requirements applying to Islamic Funds, that promote high Sharia governance standards with flexibility of application; and

- regulation of the fund management service providers, including fund administrators, custodian and trustees, thereby providing a one-stop jurisdiction for setting up a property fund platform.

In line with other developed fund regimes, the DFSA takes a modular approach to regulation. This means that sponsors can choose which type of collective investment fund they wish to establish, which will have its own foundational layer of regulation and then, if they wish to further specialise their fund, there are additional modules of DFSA regulation that apply. The documentation required to establish a fund in the DIFC must be in English.

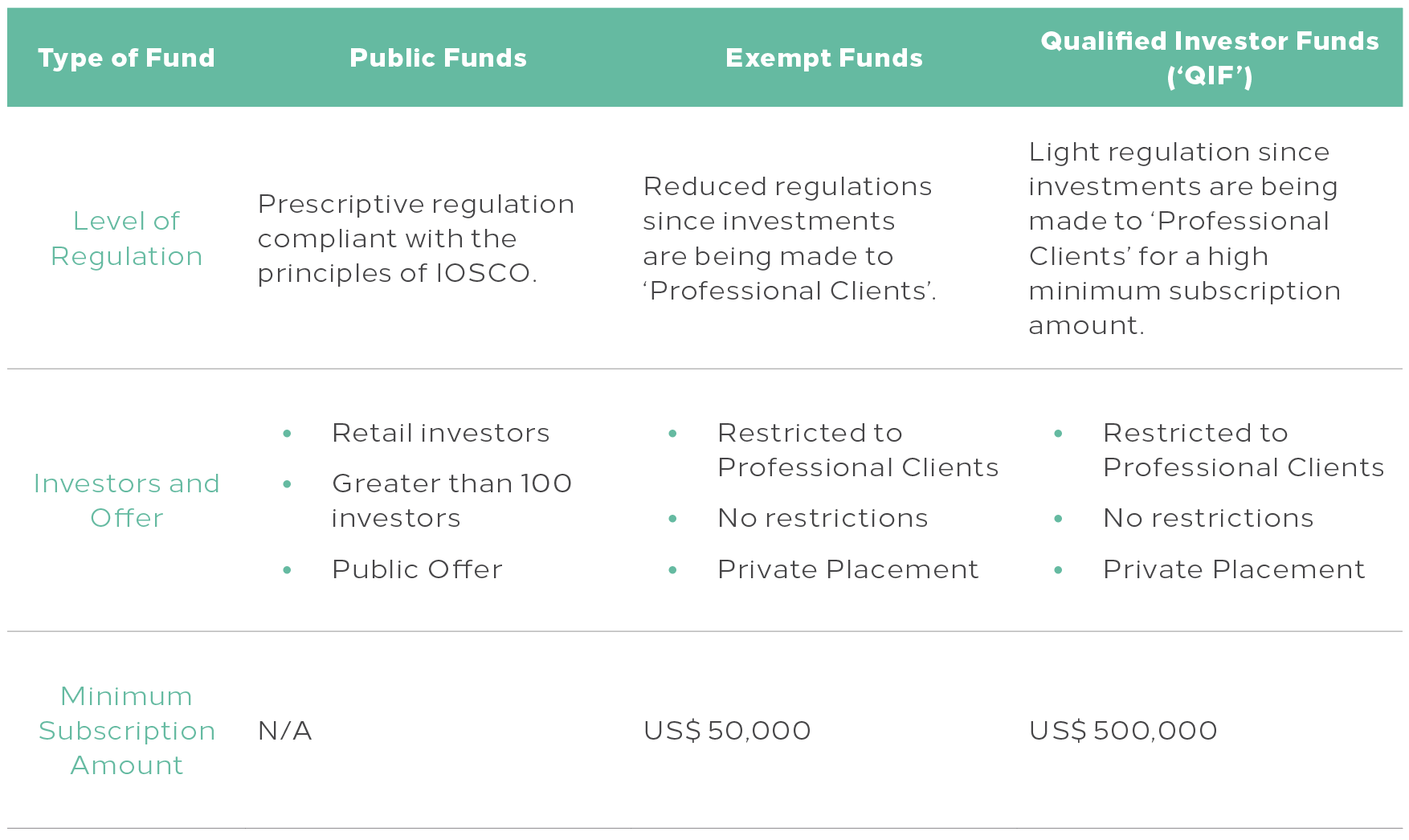

The table below sets out the key characteristics of the collective investment funds available in the DIFC that offer different platforms for large scale property investment.

As discussed above, specialist types of fund in the DIFC each have their own additional regulatory requirements. Please find brief summaries of these requirements set out below with respect to the main types of specialist funds that are deployed for real estate focused investments in the DIFC.

Property Funds

A collective investment fund is categorised as a Property Fund under DFSA regulation, if its main purpose is investment in real property and in securities issued by body corporates the main activities of which are investing in, dealing in, developing or redeveloping real property.

Save for the first six month period of the Property Fund’s operation or any other time period as set out in the prospectus or as approved by Special Resolution of its unit holders, the assets of the Property Fund must consist only of any or all of the following:

- real property;

- property related assets or units in another property fund; and

- cash, government and public securities, up to a maximum of 40 per cent of holdings.

Public Property Funds

In case a Property Fund is or intends to be a Public Fund:

- an investment company or investment trust must be utilised as the investment vehicle of the fund;

- the fund must be listed within three years of when its units are first offered to potential unitholders; and

- the constitution of the fund must include provisions that deal with: (i) the manner in which the issue and redemption of units of the fund will be made to ensure that the fund is closed-ended; and (ii) if applicable, the circumstances in which any private placements may be made.

If the offer documentation or marketing material of a Property Fund, which is also an Exempt Fund or a Qualified Investor Fund, states that it intends to be listed or traded on an Authorised Market Institution, or on an exchange in a recognised jurisdiction, it must:

- be registered as a public company;

- list and trade its units on the exchange specified in its offer document or marketing materials within three years of its registration; and

- during the period pending its listing and trading, comply with all the requirements applicable to a public fund other than the requirements relating to: (i) the independent oversight function; and (ii) the issue of a public fund prospectus.

Islamic Property Funds

Islamic Property Funds, whilst similar to conventional property funds are subject to additional compliance requirements and fund managers are required to maintain establish and maintain systems and controls which ensure that its management of the fund and the fund property is Sharia compliant. The fund manager must appoint a Sharia Supervisory Board (‘SSB’) and to have systems in place to disseminate the SSB’s rulings, conduct regular Sharia reviews and also conduct an internal audit in accordance with the Islamic Finance Rules Module of the DFSA Rulebook.

Real Estate Investment Trusts (REITs)

A REIT is a property fund which:

- is constituted either as an investment company or as an investment trust;

- may hold development property provided it does not exceed 30 per cent of the net asset value of the fund property, provided the intention is to hold such assets on completion;

- is primarily aimed at investment in income-generating real property; and

- distributes to the unitholders at least 80 per cent of its audited annual net income.

2. ADGM

The ADGM is a financial free zone located in Abu Dhabi. Based on ADGM’s direct application of common law, its funds regime balances a business friendly environment for sponsors, while retaining the appropriate levels of investor protection. Collective investment funds operating in the ADGM are regulated by the Financial Services Regulatory Authority (‘FSRA’) that is compliant with the principles of IOSCO.

Qualifying ADGM entities may acquire title to real estate in the Emirate of Abu Dhabi (inside or outside Abu Dhabi’s designated investment zones). Fund managers located both within and outside the ADGM can establish funds within its jurisdiction using a corporate, limited partnership or trust platform. Sharia compliant funds and structures are also offered by the FSRA regulations. ADGM has also developed a platform that permits start-up and boutique fund managers to establish in the ADGM to manage non-retail funds.

The FSRA regulations permit the establishment of public funds, exempt funds and qualified investor funds on essentially the same criteria of investment and regulatory oversight as does the DFSA in the DIFC.

FSRA has developed sector-specific frameworks, including a private REIT regime allowing REIT managers to launch in a private placement setting without a listing requirement, making ADGM the first international financial centre in the MENA region to offer a private REIT regime.

Pursuant to ADGM Fund Rules, a Fund Manager can only include the terms ‘Real Estate Investment Fund’ or ‘REIT’ in a Domestic Fund if the fund: (a) is primarily aimed at investment in income generating Real Property; and (b) distributes to the unitholders at least 80 per cent of its audited annual net income.

ADGM’s three independent authorities (ADGM Courts, FSRA and ADGM’s Registration Authority) provide for a complete environment for investment funds to conduct business with confidence.

The ADGM funds’ regime is the most recently established out of the Jurisdictions but the FSRA is a proactive regulatory body and the rate of progress over recent years in this Jurisdiction has been significant.

The ADGM is the first international financial centre in the MENA region to offer both a private and a public REIT regime. The ADGM recognises that some sponsors may wish to structure a REIT that is only offered by way of private placement to professional investors, while still providing other sponsors with the ability to establish public REITs in the region.

Key considerations for a successful launch

We have discussed above the regulatory Jurisdictions that the current legal framework in the UAE offers to sponsors who are desirous of setting up a property fund. Sponsors however, will need to be mindful of the practical challenges that they may face from the pre-incorporation phase until the successful launch of their fund. Given that each fund has a specific set of objectives, the relative significance of the issues, discussed below, will depend upon the specific objectives and dynamics of each property fund.

1. Structural considerations

The legal and investment advisors must analyse the particular objectives of the sponsors with a view to formulating a corporate structure that would allow the sponsors to meet their objectives. Discussions at this stage will revolve around the available types of fund, the management structure, the required capitalisation, the characteristics of the offering, including whether it would be Sharia compliant or not, and other issues of critical importance that should be clarified and agreed on from the outset. Consideration must also be given to the type of special purpose vehicles that will need to be deployed, the tax optimisation strategy, the roll-up strategy and the expected timeframe to implement the corporate structure taking into account the regulatory approvals that will be required. These structuring considerations are of significant importance because of their practical consequences. For example, the type of fund or the special purpose vehicles deployed may impact where the fund can own property within the target jurisdiction. Further, the decision as to whether or not to elect to have the fund be Sharia compliant will determine the types of real estate assets that can form part of the seed portfolio.

2. Regulatory considerations

It is essential to analyse the regulatory approvals that are required to establish a property fund. These approvals will primarily depend on the type of the fund, the type of the entities forming part of the corporate structure of the fund and the location of the properties that will be acquired by the fund. There are often a number of governmental authorities that would be involved in the process with each one of these authorities having specific rules and procedures that must be complied with. It is very important to note that some of these requirements are not necessarily written in the law and could take the form of unwritten policies and practices. The legal advisors of the sponsors should, therefore, anticipate the potential regulatory hurdles through sophisticated advance planning and early engagement with authorities on a no-names basis as governmental authorities are generally proactive in the funds sector and many hurdles can be overcome by maintaining a positive dialogue with them.

3. Acquisition programme

More often than not, sellers of real estate assets would be willing to look at scenarios other than a pure cash sale to unlock the value of their real estate holdings. This is particularly the case in the buyer’s market that currently exists in the UAE, where the pricing of real estate assets is facing downward pressure. Sponsors should seize this opportunity and consider a variety of transaction structures that could allow them to generate more profit than the classical cash based or leveraged models. They could, for instance, offer the seller units in the fund in exchange for the seller contributing the real estate asset to the fund on an in-kind basis, or potentially structure the consideration as a mix of cash and equity. The foregoing and a number of other issues, including with respect to each target acquisition of a real estate asset forming part of the seed portfolio, the kick-off date of such acquisition, the timeframes for completion and the closing mechanism, should all be part of the acquisition programme developed by the legal and investment advisors and approved by the sponsor. Careful consideration should also be given to the structuring of the acquisition of the real estate assets from the outset, in order to ensure that the transaction is as efficient from a land transfer fees perspective as is possible within the relevant jurisdiction.

4. Due diligence considerations

The application of ‘off the shelf’ due diligence queries can result in delay, waste resources or, in some instances, fail to identify the critical issues. Due diligence methods must be primarily based on the requirements of the licensing authority whilst taking into account the regime applicable in the jurisdiction in which the property is located as well as local practices. Due diligence requests that appear to the sellers of the real estate assets as particularly uncommon or unreasonable can easily distance the seller from the deal or result in the fund’s management losing credibility during the acquisition process. Equally important is the ability to identify the material issues that could have a significant impact on the fund’s interests and to distinguish them from those that are non-material or which can easily be remedied. This requires a jurisdiction-specific knowledge and an understanding of the local customs and practices. It also requires a contextual understanding of the specifics of the deal. For example, an issue that could appear material in the context of an acquisition of a single real estate asset might, however, be of lesser significance when the value of that asset is considered relative to the overall value of the seed portfolio.

5. Acquisition practices

It is essential to understand the custom and practice of acquiring properties in the target jurisdictions. For example, understanding the difference between an institutional seller who could be familiar with the range of protections that are required by the fund and a non-sophisticated seller who may not be well versed in the acquisition processes adopted by the fund, could be critical to successful deal execution. Knowing how and at what price level to start the negotiations with a seller will often be crucial in determining the success or failure of an acquisition. Similarly, permissible deal protection structures, including deposit mechanisms and liquidated damages, valuation requirements and conveyance practices adopted in these jurisdictions could likely differ in meaningful ways from what sponsors are accustomed to in other parts of the world. Sensitivity must also be shown to the decision making processes of the seller and to what could be perceived as unacceptable tactics, such as unsolicited pressure by the acquirer in the negotiations, as these practices could alienate the seller instead of closing a deal.

Although there is no single model of success when it comes to promoting real estate investments, there is a settled consensus that recognises the importance of a robust property funds’ regulatory framework to support the ever-evolving needs of sponsors and investors. In our opinion, the existing property funds’ framework in the UAE, aligns with international best practices and as such does provide the required support to promote a strong and ever-growing property funds market in the region. As in any other part of the world, however, the process to launch a property fund involves a variety of structural complexities and commercial challenges. These complexities and challenges can be easily overcome through sufficient planning and by developing a comprehensive strategy that adopts a pragmatic approach to the jurisdictional requirements of the UAE and recognises the importance of early and proactive engagement with the relevant regulators.

For further information, please contact Dennis Ryan (d.ryan@tamimi.com) or Malek Al Rifai (m.alrifai@tamimi.com).

Stay updated

To learn more about our services and get the latest legal insights from across the Middle East and North Africa region, click on the link below.