- Arbitration

- Banking & Finance

- Capital Markets

- Commercial

- Competition

- Construction & Infrastructure

- Corporate / Mergers & Acquisitions

- Corporate Services

- Corporate Structuring

- Digital & Data

- Dispute Resolution

- Employment & Incentives

- Family Business & Private Wealth

- Innovation, Patents & Industrial Property (3IP)

- Insurance

Find a Lawyer

Book an appointment with us, or search the directory to find the right lawyer for you directly through the app.

Find out more

Level Up: Unlocking Financial Potential In The Middle East

Welcome to this edition of Law Update, where we focus on the ever-evolving landscape of financial services regulation across the region. As the financial markets in the region continue to grow and diversify, this issue provides timely insights into the key regulatory developments shaping banking, investment, insolvency, and emerging technologies.

2025 is set to be a game-changer for the MENA region, with legal and regulatory shifts from 2024 continuing to reshape its economic landscape. Saudi Arabia, the UAE, Egypt, Iraq, Qatar, and Bahrain are all implementing groundbreaking reforms in sustainable financing, investment laws, labor regulations, and dispute resolution. As the region positions itself for deeper global integration, businesses must adapt to a rapidly evolving legal environment.

Our Eyes on 2025 publication provides essential insights and practical guidance on the key legal updates shaping the year ahead—equipping you with the knowledge to stay ahead in this dynamic market.

The leading law firm in the Middle East & North Africa region.

A complete spectrum of legal services across jurisdictions in the Middle East & North Africa.

-

Practices

- All Practices

- Banking & Finance

- Capital Markets

- Commercial

- Competition

- Construction & Infrastructure

- Corporate / Mergers & Acquisitions

- Corporate Services

- Corporate Structuring

-

Sectors

-

Country Groups

-

Client Solutions

Today's news and tomorrow's trends from around the region.

17 offices across the Middle East & North Africa.

Our Services

Back

Back

-

Practices

- All Practices

- Banking & Finance

- Capital Markets

- Commercial

- Competition

- Construction & Infrastructure

- Corporate / Mergers & Acquisitions

- Corporate Services

- Corporate Structuring

- Digital & Data

- Dispute Resolution

- Employment & Incentives

- Family Business & Private Wealth

- Innovation, Patents & Industrial Property (3IP)

- Insurance

- Intellectual Property

- Legislative Drafting

- Private Client Services

- Private Equity

- Private Notary

- Projects

- Real Estate

- Regulatory

- Tax

- Turnaround, Restructuring & Insolvency

- White Collar Crime & Investigations

-

Sectors

-

Country Groups

-

Client Solutions

- Law Firm

- /

- Insights

- /

- Law Update

- /

- December 2019 – January 2020

- /

- Reaching Financial Close in Kuwait WTTP Project

Reaching Financial Close in Kuwait WTTP Project

Philip Kotsis - Partner, Head of KSA - Corporate / Mergers and Acquisitions / Commercial

Aaron Dikos - Partner - Corporate / Mergers and Acquisitions / Commercial / Corporate Structuring / Capital Markets / Projects

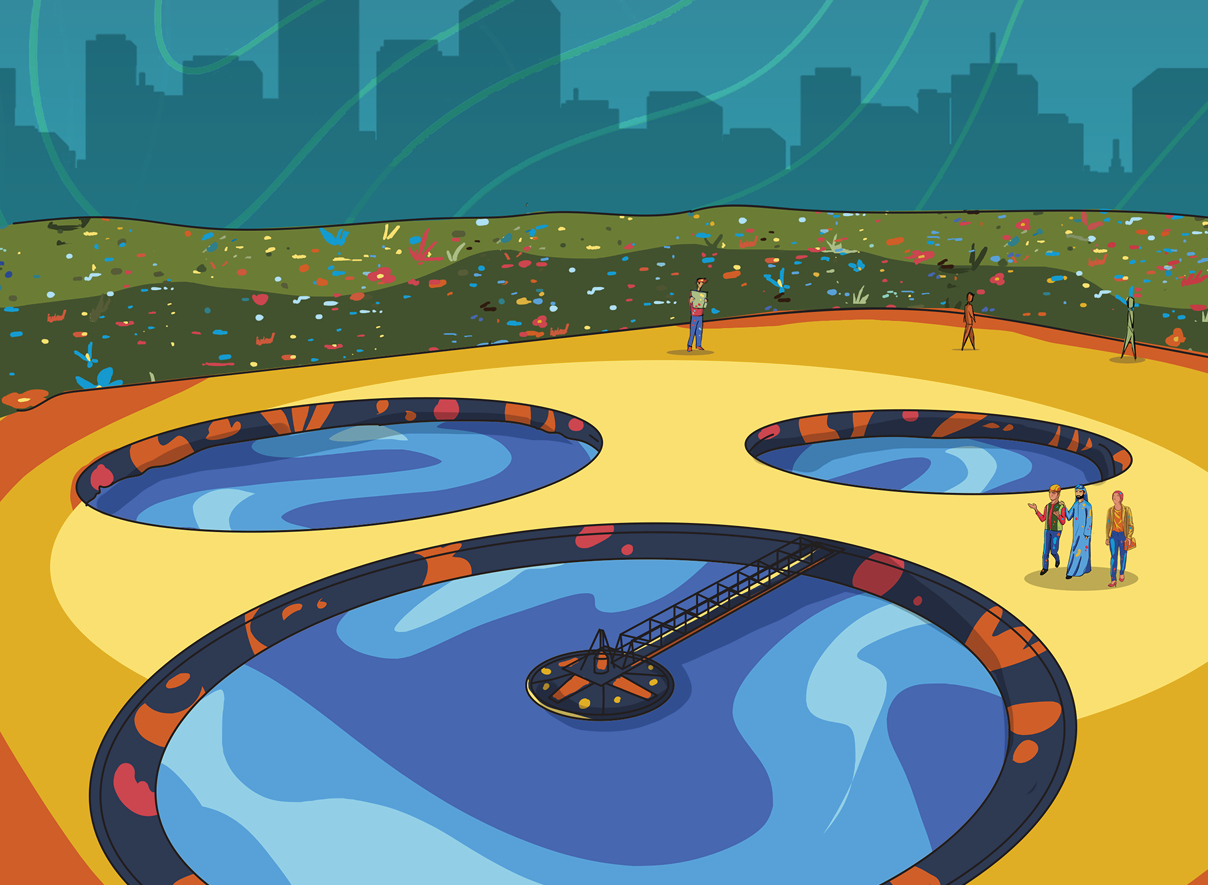

In May of 2015, the Kuwait Authority for Partnership Projects (‘KAPP’) launched a tender for the Um Al-Hayman Wastewater Treatment Plant project (the ‘UAH Project’), and in November of 2018, KAPP announced that the winning bidder of that tender was a consortium comprised of WTE Wassertechnik GmbH Group and International Financial Advisors (the ‘Investors’). The UAH Project is a US$1.6 billion project that consists of the construction, operation, maintenance and management of a new wastewater treatment plant within the parameters of the existing Um Al-Hayman plant in southern Kuwait, which will initially treat an estimated 500,000 cubic metres of average daily flow. It was tendered by KAPP, the authority tasked with the responsibility of initiating and overseeing Kuwait’s ambitious public-private partnership projects (‘PPP’) programme, pursuant to Kuwait Law No. 116 of 2014 and its executive regulations, Decree No. 78 of 2015 (the ‘PPP Law’). The UAH Project is the second PPP to be awarded by KAPP since the enactment of the PPP Law. Since the announcement of the winner, the Investors, with assistance from KAPP, have been in the process of working towards financial close, after which, construction will begin in earnest. Under the PPP Law, there are a number of events that must occur in order to reach financial close.

In May of 2015, the Kuwait Authority for Partnership Projects (‘KAPP’) launched a tender for the Um Al-Hayman Wastewater Treatment Plant project (the ‘UAH Project’), and in November of 2018, KAPP announced that the winning bidder of that tender was a consortium comprised of WTE Wassertechnik GmbH Group and International Financial Advisors (the ‘Investors’). The UAH Project is a US$1.6 billion project that consists of the construction, operation, maintenance and management of a new wastewater treatment plant within the parameters of the existing Um Al-Hayman plant in southern Kuwait, which will initially treat an estimated 500,000 cubic metres of average daily flow. It was tendered by KAPP, the authority tasked with the responsibility of initiating and overseeing Kuwait’s ambitious public-private partnership projects (‘PPP’) programme, pursuant to Kuwait Law No. 116 of 2014 and its executive regulations, Decree No. 78 of 2015 (the ‘PPP Law’). The UAH Project is the second PPP to be awarded by KAPP since the enactment of the PPP Law. Since the announcement of the winner, the Investors, with assistance from KAPP, have been in the process of working towards financial close, after which, construction will begin in earnest. Under the PPP Law, there are a number of events that must occur in order to reach financial close.

Execution of a Letter Agreement and Agreement in Principle on the Project Documentation

In accordance with the PPA Law, the winning bidder, the Investors, KAPP and the public authority participating in the UAH Project, the Kuwait Ministry of Public Works (‘MPW’), initially signed a letter agreement (the ‘Letter Agreement’) which provides the road map that the parties shall follow from the date of the announcement until financial close. Attached to the Letter Agreement were a variety of project agreements which the parties agreed to in principle (but will not be formally signed or become legally effective until financial close is achieved) and which will eventually govern the implementation of the UAE Project. The suite of project agreements includes:

- a Transmission and Sewage Treatment PPP Agreement;

- several Land Lease Agreements in relation to the site of the wastewater treatment plant, the site at which emergency sea outfall will be directed and the site of electrical facilities;

- a Shareholders Agreement which will govern the parties’ ownership, rights and obligations in the Project Company (hereinafter described); and

- a Step-in Agreement which will allow substitution of the Investors in the event they materially fail to implement the UAH Project in accordance with the agreed requirements.

Subsequent to the signing of the Letter Agreement, the Investors then began establishing the corporate and financial structure under which the UAH Project will be implemented.

Moving towards Financial Close

After execution of the Letter Agreement, the first order of business for the Investor to complete, pursuant to the PPP Law, was the establishment of a Kuwaiti company (the ‘Consortium Company’) which serves essentially as a holding company through which the Investors will exercise their ownership rights and obligations in the Project Company (hereinafter defined). The Consortium Company will then be a party to the Shareholders Agreement that governs the management and operations of the Project Company. The Investors completed establishment of the Consortium Company in November of 2019. While Kuwait law imposes certain restrictions on the amount of equity that non-GCC nationals can own in a Kuwaiti company, the PPP Law expressly waives such restriction vis-à-vis the Consortium Company and the Project Company. As such, WTE Wassertechnik GmbH Group was legally permitted to own the majority of the equity in the Consortium Company.

Now that the Consortium Company has been established, the Investor, KAPP and the MPW have begun the process of incorporating the Kuwaiti company that will perform the UAH Project (the ‘Project Company’). The Project Company will enter into all of the other project agreements (aside from the Shareholders Agreement, the parties to which will initially be the Consortium Company and KAPP). The Transmission and Sewage Treatment PPP Agreement will be entered into between the Project Company and it will serve as the master framework agreement pursuant to which the UAH Project will be undertaken. The Project Company and the MPW will also enter into the various Land Lease Agreements which will ensure that the Project Company has the requisite access and usage rights to the land on which the wastewater treatment plan will be constructed.

The Letter Agreement provides that the Project Company will be capitalised in a series of increments based on a timeline that starts from the date of incorporation of the Project Company. At the outset, the Consortium Company will own 40 per cent of the equity shares in the Project Company and KAPP will own the remaining 60 per cent. However, KAPP’s primary role in its ownership of such shares is to warehouse them until the UAH Project reaches a state of commercial operations. At that point, 50 per cent of the shares that are owned by KAPP will be listed on the Boursa Kuwait and offered to Kuwaiti citizens in an initial public offering. The remaining 10 per cent of the shares that are owned by KAPP will be transferred to the MPW and the MPW will then effectively become a party to the Shareholders Agreement.

Through the provisions of the Shareholders Agreement, and pursuant to the PPP Law, the Consortium Company (and, by extension, the Investors) will exercise effective managerial control over the Project Company even though it will only own 40 per cent of its shares. The Shareholders Agreement contains voting obligations that ensure that the Consortium Company will, at all times, be able to seat a majority of the board of directors of the Project Company and appoint the primary executive officers of the Project Company.

One of the most important changes that the PPP Law made to the PPP regime in Kuwait was the expansion on the assets and rights that can be legally pledged in favour of lenders in order to secure financing for projects. Prior to the PPP Law, Kuwait law was seen by many international lenders as too restrictive and unreliable because it prohibited the mortgage of land as well as the buildings and arguably even the equipment situated on the land. Lenders were effectively prevented from being able to take effective security over the material assets of the project, which diminished lenders’ willingness to provide the necessary financing for carrying out projects. Due to the nature of limited recourse financing, lenders need to ensure that any and all security available to them is properly registered and perfected. The PPP Law has relaxed such restrictions and prohibitions and clarified what may be pledged as security. The PPP Law codifies some of the financing techniques that will be applied in the UAH Project such as assignments of proceeds, pledges against shares in both the Project Company and the Consortium Company, and mortgages over the assets comprising the UAH Project (other than the land on which the project will be conducted). The PPP Law also provides more clarity than previously existed on the procedures to be undertaken in the event the project needs to be transferred to new investors, and such procedures are contractually reflected in the Step-In Agreement that will be entered into between MPW, the Project Company and a security agent on behalf of lenders. These changes that the PPP Law has implemented have created a legal environment that makes PPP in Kuwait more bankable and attractive to international lenders and they have proven to be instrumental in helping get the UAH Project this close to financial close.

Conclusion

Once the Project Company is established (which is expected to occur by the end of January 2020) and the last remaining conditions precedent to financial close (which will consist primarily of the obtainment of regulatory approvals, permits and licenses for the Project Company and its subcontractors), construction of the wastewater plant will begin in earnest. When that happens, the UAH Project will be the second PPP to reach financial close since the inception of the PPP Law (the first being Phase One of the Az-Zour North Independent Water and Power Project). Although it is not the first PPP to reach financial close under KAPP’s stewardship, it still marks an important milestone for KAPP, its PPP programme and for the development and international standing of Kuwait as a whole. The UAH Programme signals to international lenders and companies that engage in PPP that Kuwait is taking its PPP programme and its infrastructural development seriously and that it has a legal and political environment in which PPP are bankable and feasible. As a result, there are a number of other PPP in KAPP’s pipeline that appear to have a high likelihood of eventually coming to fruition, in sectors such as transportation, real estate development, power production and solid waste management.

For further information, please contact Philip Kotsis (p.kotsis@tamimi.com).

Stay updated

To learn more about our services and get the latest legal insights from across the Middle East and North Africa region, click on the link below.