- Arbitration

- Banking & Finance

- Capital Markets

- Commercial

- Competition

- Construction & Infrastructure

- Corporate / Mergers & Acquisitions

- Corporate Services

- Corporate Structuring

- Digital & Data

- Dispute Resolution

- Employment & Incentives

- Family Business & Private Wealth

- Innovation, Patents & Industrial Property (3IP)

- Insurance

Find a Lawyer

Book an appointment with us, or search the directory to find the right lawyer for you directly through the app.

Find out more

Level Up: Unlocking Financial Potential In The Middle East

Welcome to this edition of Law Update, where we focus on the ever-evolving landscape of financial services regulation across the region. As the financial markets in the region continue to grow and diversify, this issue provides timely insights into the key regulatory developments shaping banking, investment, insolvency, and emerging technologies.

2025 is set to be a game-changer for the MENA region, with legal and regulatory shifts from 2024 continuing to reshape its economic landscape. Saudi Arabia, the UAE, Egypt, Iraq, Qatar, and Bahrain are all implementing groundbreaking reforms in sustainable financing, investment laws, labor regulations, and dispute resolution. As the region positions itself for deeper global integration, businesses must adapt to a rapidly evolving legal environment.

Our Eyes on 2025 publication provides essential insights and practical guidance on the key legal updates shaping the year ahead—equipping you with the knowledge to stay ahead in this dynamic market.

The leading law firm in the Middle East & North Africa region.

A complete spectrum of legal services across jurisdictions in the Middle East & North Africa.

-

Practices

- All Practices

- Banking & Finance

- Capital Markets

- Commercial

- Competition

- Construction & Infrastructure

- Corporate / Mergers & Acquisitions

- Corporate Services

- Corporate Structuring

-

Sectors

-

Country Groups

-

Client Solutions

Today's news and tomorrow's trends from around the region.

17 offices across the Middle East & North Africa.

Our Services

Back

Back

-

Practices

- All Practices

- Banking & Finance

- Capital Markets

- Commercial

- Competition

- Construction & Infrastructure

- Corporate / Mergers & Acquisitions

- Corporate Services

- Corporate Structuring

- Digital & Data

- Dispute Resolution

- Employment & Incentives

- Family Business & Private Wealth

- Innovation, Patents & Industrial Property (3IP)

- Insurance

- Intellectual Property

- Legislative Drafting

- Private Client Services

- Private Equity

- Private Notary

- Projects

- Real Estate

- Regulatory

- Tax

- Turnaround, Restructuring & Insolvency

- White Collar Crime & Investigations

-

Sectors

-

Country Groups

-

Client Solutions

- Law Firm

- /

- Insights

- /

- Law Update

- /

- August 2018

- /

- Regulation of Crypto Assets at ADGM

Regulation of Crypto Assets at ADGM

Divya Abrol Gambhir - Partner - Banking and Finance

Ashish Banga - Senior Associate - Consultant - Banking and Finance

Taking a lead on the regulation of crypto assets in the Abu Dhabi Global Market (“ADGM”), the Financial Services Regulatory Authority (“FSRA”) issued Guidance on Regulation of Crypto Asset Activities in ADGM (the “Regulations”). The Regulations are supplementary to and should be read in conjunction with FSRA’s Guidance on Regulation of Initial Coin/Token Offerings and Virtual Currencies under the Financial Services and Markets Regulations 2015 issued on 9 October 2017 (the “ICO Guidance”).

Taking a lead on the regulation of crypto assets in the Abu Dhabi Global Market (“ADGM”), the Financial Services Regulatory Authority (“FSRA”) issued Guidance on Regulation of Crypto Asset Activities in ADGM (the “Regulations”). The Regulations are supplementary to and should be read in conjunction with FSRA’s Guidance on Regulation of Initial Coin/Token Offerings and Virtual Currencies under the Financial Services and Markets Regulations 2015 issued on 9 October 2017 (the “ICO Guidance”).

The Regulations together with applicable rules and regulations governing crypto assets, as issued by the FSRA, provides for a comprehensive Spot Crypto Asset Framework (the “Framework”). The Regulation sets out and limits the FSRA’s approach to the regulation of crypto asset activities in and from the ADGM, including activities conducted by crypto asset exchanges, crypto asset custodians and intermediaries engaged in crypto asset activities.

For purposes of the Regulations and the Framework, Crypto Assets are a digital representation of value that can be digitally traded and functions as a: (a) medium of exchange; (b) unit of account; and/or (c) a store of value. These: (i) do not have a legal tender status in any jurisdiction; (ii) are neither issued nor guaranteed by any jurisdiction and fulfil its functions only by agreement within the community of users of such assets; and (iii) are distinguished from fiat currencies including electronic money.

Initial Coin Offerings

The Framework is not intended to apply to initial token or coin offerings (“ICOs”) and such offerings will continue to be regulated in accordance with the ICO Guidance. The ICO Guidance clarifies the nature of token offerings (utility or security) that are permissible in the ADGM.

Objectives of the Framework

While, the fact that crypto assets can be created, stored and transferred without the need of any third party makes it attractive for its users, it also raises significant regulatory concerns for regulatory authorities and law enforcement agencies worldwide, particularly in relation to money laundering, terrorism financing, consumer protection, market abuse, amongst other risks.

The FSRA under the Framework addresses these risks in addition to issues that may arise in connection with protection of client money, safe custody, technology governance and disclosure and transparency, which makes it an attractive and comparatively secure jurisdiction for conducting crypto related activities.

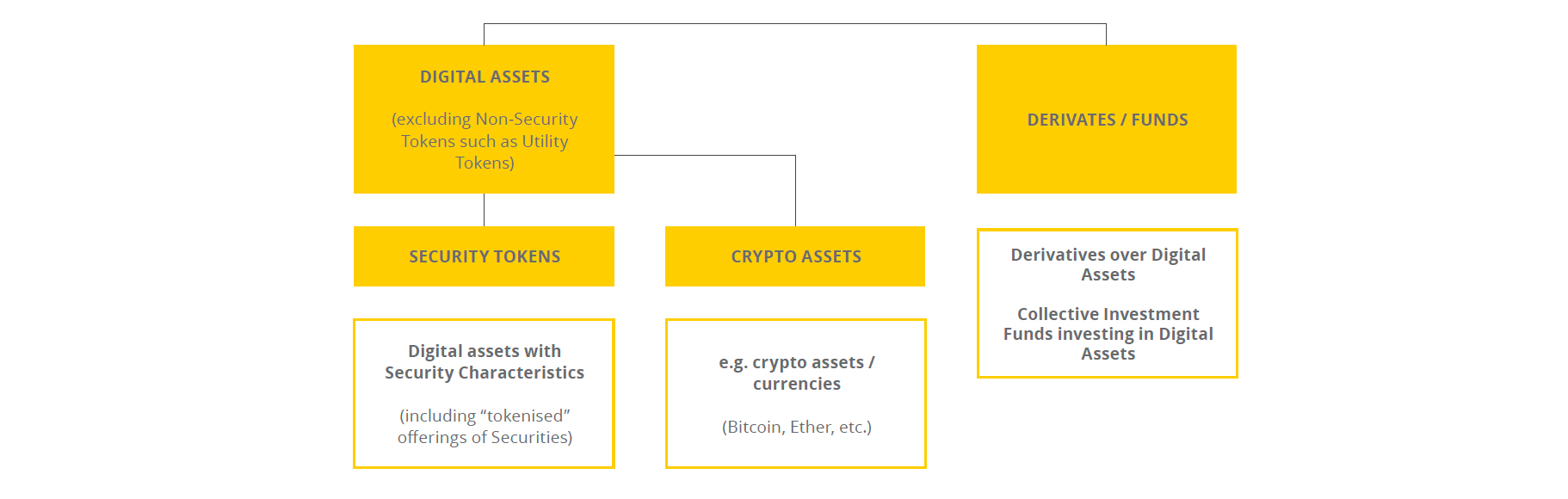

Notwithstanding that crypto assets are deemed as commodities and are not considered a “Specified Investment” (for purposes of Financial Services and Markets Regulations, 2015, as may be amended from time to time (FSMR)), to ensure adequate consumer protection, while meeting demands in this market space, the FSRA has rightly provided for certain activities associated with crypto assets to be regulated. The diagram sets out FSRA’s approach in relation to different type of digital assets.

Operating a Crypto Asset Business

Who can Operate a Crypto Asset Business (“OCAB”) in and from the ADGM?

- new applicants;

- authorised persons (i.e. persons authorised to carry on other regulated activities within the ADGM); and

- recognised investment exchanges.

Amongst these, applicants that qualify for authorisation under the Framework will be granted a Financial Service Permission (“FSP”) to carry on regulated activity of OCAB.

OCAB permits undertaking of one or more crypto asset activities, which include:

- buying, selling or exercising any right in accepted crypto assets (whether as principal or agent);

- managing accepted crypto assets belonging to another person;

- making arrangements with a view to another person (whether as principal or agent) buying, selling or providing custody of accepted crypto assets;

- marketing of accepted crypto assets;

- advising on the merits of buying or selling of accepted crypto assets or any rights conferred by such buying or selling; and

- operating a crypto asset exchange or operating as a crypto asset custodian.

The FSRA’s approach to the regulatory treatment of crypto assets in the ADGM is encouraging. The Framework makes it evident that: (a) crypto asset activities may only be permitted in connection with crypto assets that are categorised as “Accepted Crypto Assets” i.e. those crypto assets that fulfil criteria prescribed by the FSRA; and (b) any person dealing with such accepted crypto assets including intermediaries (such as brokers/dealers, asset managers, crypto asset exchanges, crypto asset custodians) involved in dealing, managing or arranging Accepted Crypto Assets, would require an FSP to operate in and from the ADGM.

However: (i) creation or administration of crypto assets; (ii) development, dissemination or use of software for the purpose of creating or mining a crypto asset; (iii) transmission of crypto assets; (iv) loyalty points scheme denominated in crypto assets; and (v) such other activity as may be determined by the FSRA to not constitute OCAB, shall not constitute OCAB and therefore will not be subject to the Framework.

Crypto Asset Exchanges and Crypto Asset Custodians

Whilst most of the crypto asset activities are subject to similar regulations within the Framework, the FRSA considers the crypto asset activities conducted by crypto asset exchanges and crypto asset custodians a key crypto activity in the ADGM. Therefore the Framework levies specific additional requirements applicable to such participants.

Crypto Asset Exchanges

In addition to the requirements applicable to other crypto asset activities, additional requirements for a crypto asset exchange would include substantial commercial, governance, compliance, technical, information technology and human resources presence within the ADGM. A recognised investment exchange may operate as a crypto asset exchange, as part of the regulated activity of OCAB, provided that recognition order of such exchange includes a stipulation, permitting it to do so. In such cases, such exchanges would be subject to the Framework (including fees applicable for conducting OCAB) in addition to other regulations and fees (including market infrastructure rule), it already is subject to.

Crypto Asset Custodians

As regards crypto asset custodians, the FRSA has taken a similar approach to that of other custodian activities permitted within the ADGM. In order to afford the same protection the FSRA offers to other similar products within the FSMR (including relevant rule books) it has widened the scope of definitions of “Providing Custody”, “Client Assets”, “Client Investments” and “Investment Business” (as defined under the FSMR) to include crypto assets and OCAB.

Fees

The fees for OCAB are comparatively higher than most other regulated activities within the ADGM. In addition to the fees applicable to crypto asset exchanges, a trading fees is levied on such exchanges, which is payable on a monthly basis. This is calculated as a percentage of trades conducted for each month.

Conclusion

The Regulations are a welcome change and seem to address regulatory requirements around crypto asset activities within the ADGM. We are hopeful that this would encourage other financial regulators within the region to issue regulations and therefore provide options to potential applicants.

Al Tamimi & Company’s banking and finance team regularly advises on issues in relation to crypto assets. For further information please contact Ms. Divya Abrol Gambhir (d.abrol@tamimi.com) or Mr. Ashish Banga (a.banga@tamimi.com).

Stay updated

To learn more about our services and get the latest legal insights from across the Middle East and North Africa region, click on the link below.