- Arbitration

- Banking & Finance

- Capital Markets

- Commercial

- Competition

- Construction & Infrastructure

- Corporate / Mergers & Acquisitions

- Corporate Services

- Corporate Structuring

- Digital & Data

- Dispute Resolution

- Employment & Incentives

- Family Business & Private Wealth

- Innovation, Patents & Industrial Property (3IP)

- Insurance

Find a Lawyer

Book an appointment with us, or search the directory to find the right lawyer for you directly through the app.

Find out more

Level Up: Unlocking Financial Potential In The Middle East

Welcome to this edition of Law Update, where we focus on the ever-evolving landscape of financial services regulation across the region. As the financial markets in the region continue to grow and diversify, this issue provides timely insights into the key regulatory developments shaping banking, investment, insolvency, and emerging technologies.

2025 is set to be a game-changer for the MENA region, with legal and regulatory shifts from 2024 continuing to reshape its economic landscape. Saudi Arabia, the UAE, Egypt, Iraq, Qatar, and Bahrain are all implementing groundbreaking reforms in sustainable financing, investment laws, labor regulations, and dispute resolution. As the region positions itself for deeper global integration, businesses must adapt to a rapidly evolving legal environment.

Our Eyes on 2025 publication provides essential insights and practical guidance on the key legal updates shaping the year ahead—equipping you with the knowledge to stay ahead in this dynamic market.

The leading law firm in the Middle East & North Africa region.

A complete spectrum of legal services across jurisdictions in the Middle East & North Africa.

-

Practices

- All Practices

- Banking & Finance

- Capital Markets

- Commercial

- Competition

- Construction & Infrastructure

- Corporate / Mergers & Acquisitions

- Corporate Services

- Corporate Structuring

-

Sectors

-

Country Groups

-

Client Solutions

Today's news and tomorrow's trends from around the region.

17 offices across the Middle East & North Africa.

Our Services

Back

Back

-

Practices

- All Practices

- Banking & Finance

- Capital Markets

- Commercial

- Competition

- Construction & Infrastructure

- Corporate / Mergers & Acquisitions

- Corporate Services

- Corporate Structuring

- Digital & Data

- Dispute Resolution

- Employment & Incentives

- Family Business & Private Wealth

- Innovation, Patents & Industrial Property (3IP)

- Insurance

- Intellectual Property

- Legislative Drafting

- Private Client Services

- Private Equity

- Private Notary

- Projects

- Real Estate

- Regulatory

- Tax

- Turnaround, Restructuring & Insolvency

- White Collar Crime & Investigations

-

Sectors

-

Country Groups

-

Client Solutions

- Law Firm

- /

- Insights

- /

- Law Update

- /

- Family Business, Real Estate & Construction: Building for the future

- /

- Succession Planning for Family Owned Properties

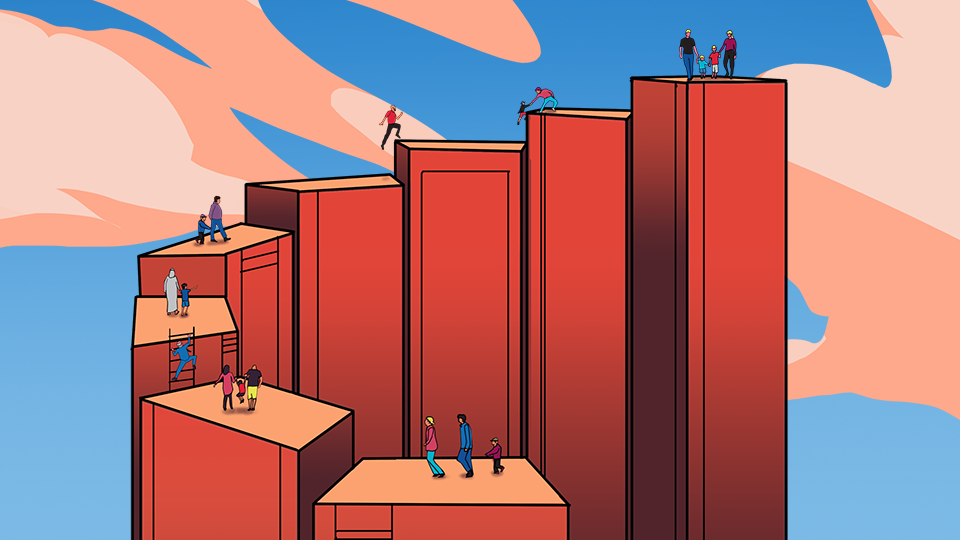

Succession Planning for Family Owned Properties

In the United Arab Emirates, businesses and enterprises are usually inclined to follow a straightforward, simple corporate structure, wherein the founding members of the family business commonly retain ownership of the business and any real estate properties within the family business in their own individual capacities. The undertaking of this form of simple structures is beneficial as its transparency allows it to be easily absorbed and correlated into the structuring of an enterprise or business.

Nonetheless, family businesses and specifically the real estate assets owned through the family members or simple corporate structures can be endangered under certain circumstances, an instance of which includes the death or passing of the owner. This leads to inheritance disputes and lengthy litigation proceedings to be settled, which primarily revolve around the heirs inability to handle the real estate properties that are registered under the name of the late owner without transferring it their own names, which in itself is a time-consuming endeavour.

That said, there are more sophisticated and robust corporate structures that can be adopted by such large family businesses to ensure that the operation and management of the family business and real estate properties do not get interrupted following the passing away of the founding members, and would avoid or limit any exposure by the surviving members to inheritance disputes and litigation proceedings. The aim of this article is to highlight how the utilization of such fairly new and sophisticated corporate structures aid in acting as a defensive mechanism to protect the business and real estate assets following the passing away of the founding members.

Foundations

A foundation is a form of corporate vehicle wherein it is set out as being the allocation of a specific amount of the founder(s) assets towards certain purposes or individuals. The introduction of Dubai International Financial Centre (DIFC) Law Number 3 of 2018 is a key corporate structuring development that entitled family businesses to set up a DIFC foundation, which in itself acts as a highly recommended structure in regards to succession planning that is used by families to address matters concerning the ownership of properties and assets.

DIFC foundations allow the founder(s) to distinguish and separate between their commercial and personal assets and properties by re-structuring the ownership of the personal assets and re-locating them into the foundation, with respect to the UAE’s ownership limitations. Furthermore, DIFC foundations are extremely flexible in regards to the management and governance of the foundation and allows the founder(s) to constantly remain in control of any assets transferred to the foundation.

Real Estate Assets ownership by DIFC foundations in Dubai:

The DIFC entered a Memorandum of Understanding (MOU) with the Dubai Land Department (DLD), which allowed for the purchase and registration of DIFC based entities for property rights and real property in coordination with the DLD, and entitles DIFC foundations to own real estate assets in Dubai in areas that are designed for foreign ownership.

Trust Structures

A trust is a legally binding arrangement that entails when an individual (the beneficial owner) transfers the legal ownership of assets and properties to others (the trustees) in order for them to be held onto on the basis of trust for the benefit of the beneficial owner or the individuals named to receive those benefits (the beneficiaries). The beneficiaries can be natural individuals, family members or third parties, and can be organizations such as charities. This arrangement leads to the trustee being the legal owner on all official records responsible for managing the trust properties.

There are many benefits for adopting a trust structure to manage the family business properties, which are mainly reducing tax liabilities and inheritance disputes, and ensures that the family business and the ownership of real estate properties continues following the passing away for the founding family members. Therefore, a trust structure also ensures that the inexperienced surviving family members are not left with the decision taking and management of the family business, which would often lead to the collapse of the family business.

The appointed trustees are experienced individuals and firms capable of the management of the family business and real property rights, and are trusted with the distribution of the benefits generated from the family business and real property rights to the beneficiates are determined in the trust deed.

Why Use Foundations and Trusts?

These corporate structuring methodologies aids in smoothly handling any problems that the family business may face after the passing of any of the founding members of the family business; as the passing away of an individual in the UAE leads to that individual’s property (including any real estate assets) will be distributed in accordance with Sharia law and in accordance with the UAE law.

The application of the abovementioned corporate structuring approaches offers a level of shielding against potential inheritance risks that would inevitably disrupt and adversely impact the family business.

The Dubai Property Laws and Policies

Property ownership of real estate assets by individual or corporate entities is heavily regulated in Dubai, and subject to Law Number 7 of 2006 Concerning Real Property Registration in Dubai (Property Law). Article 4 of the Property Law states:

“The right to own Real Property in the Emirate will be restricted to UAE nationals, nationals of the Gulf Cooperation Council member states and to companies fully owned by these, and to public joint stock companies. Subject to the approval of the Ruler, non-UAE nationals may, in certain area determined by the Ruler, be granted the following rights:

- Freehold ownership of Real Property without time restrictions; and,

- Usufruct or leasehold over Real Property for a period not exceeding ninety-none (99) years.”

The above Article does not exclude foundations and trust, but in practice, the DLD does not allow trusts and foundations (save for DIFC foundations) to own any property rights in Dubai, and the DLD considers the individual legal owners of any corporate structures as the beneficial owners of the properties owned by such company.

Any side agreement or trust arrangement that is not registered with the DLD will not be considered by the DLD, and it is not enforceable before the local courts. In this regard, Article 7 of the Property Law states: “A Property Register will be maintained in the Department to record all Real Property Rights and any amendments thereto. This Property Register will have the absolute evidentiary value against all parties and the validity of its data may not be impugned unless it is proven to be the result of fraud or forgery.”

In further support of the above, Article 9 of the Property Law states: “All transactions that create, transfer, amend, or extinguish Real Property Rights will be recorded in the Property Register. Likewise, final rulings validating such transactions will also be registered. Such transactions will not be deemed valid unless recorded in the Property Register.”

Conclusion

Foundations are a fairly new corporate structure in Dubai and the UAE, and as important as structuring of family businesses and family owned real estate properties, it is important to seek professional legal advice from capable law firms with dedicated real estate and corporate structuring teams to consider the particular conditions of each family business and provide sound legal advice accordingly.

For further information, please contact Mohammed Kawasmi (M.Kawasmi@tamimi.com) or Abdulla Khaled (A.Khaled@tamimi.com).

Stay updated

To learn more about our services and get the latest legal insights from across the Middle East and North Africa region, click on the link below.