- Arbitration

- Banking & Finance

- Capital Markets

- Commercial

- Competition

- Construction & Infrastructure

- Corporate / Mergers & Acquisitions

- Corporate Services

- Corporate Structuring

- Digital & Data

- Dispute Resolution

- Employment & Incentives

- Family Business & Private Wealth

- Innovation, Patents & Industrial Property (3IP)

- Insurance

Find a Lawyer

Book an appointment with us, or search the directory to find the right lawyer for you directly through the app.

Find out more

Level Up: Unlocking Financial Potential In The Middle East

Welcome to this edition of Law Update, where we focus on the ever-evolving landscape of financial services regulation across the region. As the financial markets in the region continue to grow and diversify, this issue provides timely insights into the key regulatory developments shaping banking, investment, insolvency, and emerging technologies.

2025 is set to be a game-changer for the MENA region, with legal and regulatory shifts from 2024 continuing to reshape its economic landscape. Saudi Arabia, the UAE, Egypt, Iraq, Qatar, and Bahrain are all implementing groundbreaking reforms in sustainable financing, investment laws, labor regulations, and dispute resolution. As the region positions itself for deeper global integration, businesses must adapt to a rapidly evolving legal environment.

Our Eyes on 2025 publication provides essential insights and practical guidance on the key legal updates shaping the year ahead—equipping you with the knowledge to stay ahead in this dynamic market.

The leading law firm in the Middle East & North Africa region.

A complete spectrum of legal services across jurisdictions in the Middle East & North Africa.

-

Practices

- All Practices

- Banking & Finance

- Capital Markets

- Commercial

- Competition

- Construction & Infrastructure

- Corporate / Mergers & Acquisitions

- Corporate Services

- Corporate Structuring

-

Sectors

-

Country Groups

-

Client Solutions

Today's news and tomorrow's trends from around the region.

17 offices across the Middle East & North Africa.

Our Services

Back

Back

-

Practices

- All Practices

- Banking & Finance

- Capital Markets

- Commercial

- Competition

- Construction & Infrastructure

- Corporate / Mergers & Acquisitions

- Corporate Services

- Corporate Structuring

- Digital & Data

- Dispute Resolution

- Employment & Incentives

- Family Business & Private Wealth

- Innovation, Patents & Industrial Property (3IP)

- Insurance

- Intellectual Property

- Legislative Drafting

- Private Client Services

- Private Equity

- Private Notary

- Projects

- Real Estate

- Regulatory

- Tax

- Turnaround, Restructuring & Insolvency

- White Collar Crime & Investigations

-

Sectors

-

Country Groups

-

Client Solutions

- Law Firm

- /

- Insights

- /

- Law Update

- /

- December 2017 – January 2018

- /

- The UAE’s ADGM SPVs: An option for Securitisation

The UAE’s ADGM SPVs: An option for Securitisation

Ashish Banga - Senior Associate - Consultant - Banking and Finance

There has been an increasing interest of foreign investors in the use of special purpose vehicles (‘SPV’) in the structuring of securitisation transactions in the UAE. The financial free zones in the UAE i.e. the Abu Dhabi Global Market (‘ADGM’) and Dubai International Financial Centre (DIFC) have played a pivotal role in attracting this interest by providing an option of a flexible, robust, simple and efficient SPV regime that is well suited as a legal entity for securitising a portfolio of assets.

Businesses that wish to transform their illiquid assets to cashflow usually opt for either a factoring or securitisation structure, both of which enable a business to sell its assets (usually account receivables, i.e. outstanding monies owed to that business) to third parties at a discounted price. While under a factoring transaction, third parties are typically banks and financial institutions, under a securitisation structure, the idea is to procure funding from not just the banking sector but from the wider investment and capital markets.

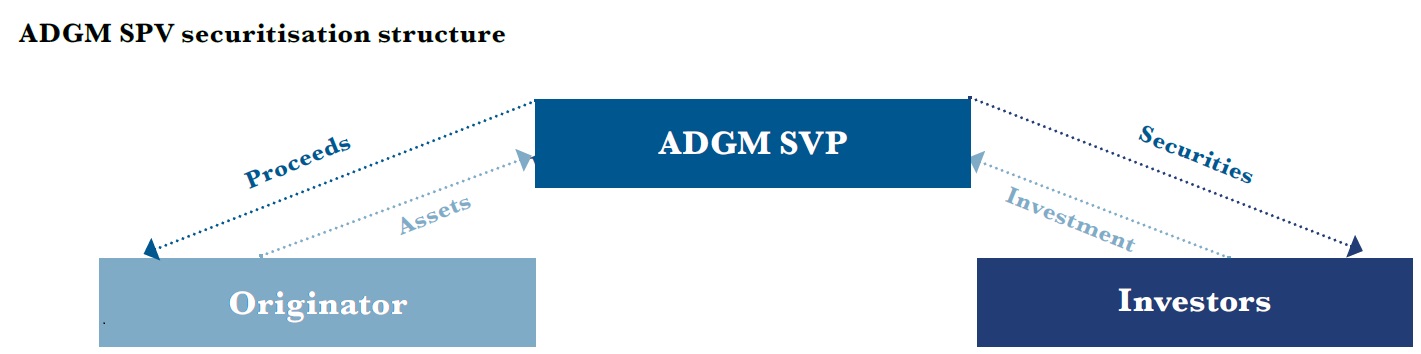

Under a securitisation structure, the twin objectives of transferring assets for the benefit of investors and, at the same time creating a capital market instrument can be achieved by using a SPV. SPVs are specifically and solely created for the purpose of: (i) holding assets sought to be transferred by the originator, the assets, once transferred, are ring fenced for the benefit of the beneficiaries of the SPV; and (ii) the issuance of financial instruments by the SPV, providing exposure to the underlying assets transferred to the SPV. Investors do not have to acquire or purchase all of the assets of the originator directly, but they do so indirectly through the securities issued by the SPV with their investment decision depending on their risk and investment appetite. In practice, while the assets of the originator are transferred to the SPV, making the SPV the legal owner of the underlying assets, the SPV is a conduit between the assets and the ultimate investors, making the holders of the securities the ultimate beneficiaries of the underlying assets.

Under the laws of UAE, the restrictions on foreign shareholding and filing requirements often make it difficult for foreign investors to set up an onshore SPV and implement a securitisation transaction. Also, UAE law does not recognise the notion of a trust removing the availability of a critical structuring tool employed in securitisation. However, the basis of the ADGM and DIFC legal framework is English and common law meaning trust structures can be used in connection with its SPV regime. For purposes of this Article we will limit ourselves to benefits of securitisation structure under ADGM.

A typical securitisation structure under ADGM’s ambit can be explained as below.

By virtue of being incorporated in the ADGM, the SPV regime offers a number of benefits including:

- No foreign ownership restrictions. ADGM entities are not subject to any requirement of minimum shareholding by UAE nationals. Therefore, 100 per cent of the SPV may be owned by a foreign national or group of foreign nationals.

- Tax Residency. All ADGM registered companies are eligible to apply a Tax Residency Certificate from the UAE Ministry of Finance to benefit from the UAE’s Double Tax Treaty network. This is subject to meeting the criteria of Ministry of Finance. In addition to this, there are no (a) withholding taxes, or (b) restrictions on repatriation of profits.

- No Office Space Required. Unlike an ordinary ADGM company limited by shares, an ADGM SPV is not required to take office space, however, they must provide a registered address on Al Maryah Island. This will ordinarily be the address of its appointed service provider and is similar to the registered office requirement in other jurisdictions. This exemption of office space removes a significant cost of setting up of an SPV.

- Migration or continuance of existing corporate entities. ADGM permits the relocation and redomicile of companies to ADGM from other jurisdiction. A company that is incorporated outside ADGM may apply for the issuance of a certificate confirming that it continues as a company registered under the ADGM Companies Regulations. The company must be authorised to make such an application by the laws of the jurisdiction under which it is currently incorporated.

- Legal and Regulatory. In terms of legal and regulatory aspects governing the SPV, the direct applicability of common law ensures a high level of legal certainty and provides comfort to foreign investors coming from a common law background. In particular, SPVs have access to ADGM’s sophisticated regime for registration and enforcement of security interests, which is often a critical factor in selecting a jurisdiction in which to incorporate SPVs for a securitisation transaction.

- Holding Company. While the DIFC and the ADGM options allow for securitisation transactions, the ‘holding’ company concept is radically different in both centres. It must be noted though that the name ‘special purpose vehicle’ inherently means an entity created for a special purpose, and implies a temporary nature. However, the ADGM does allow these SPVs to function as ultimate holding companies, which, in theory, can continue in perpetuity.

In addition to these benefits, there are certain other benefits that may incentivise foreign entities to set up SPVs under the ADGM regime for a securitisation structure, such as: independent ADGM Courts; an efficient timing for set-up; no restriction on the number of shareholders; a quick and easy fully digital registration process; no attestation requirement for corporate documents; which may incentivize foreign entities to set up SPVs under the ADGM regime for a securitisation structure.

However, an SPV set up for a securitisation structure cannot conduct ‘financial services’ in or from the ADGM, unless it is appropriately authorised and regulated by the Financial Services Regulatory Authority. This would depend upon the business plan discussed and submitted with the Financial Services Regulatory Authority. Subject to the review of this plan and objectives of the structure, an SPV is advised by the Financial Services Regulatory Authority on the kind of licensing they are required to adhere to under the financial regulations of the ADGM.

The financial participants interested in setting up a securitisation structure within the UAE may consider ADGM as a potential option in addition to already existing options under the DIFC, given the benefits these financial free zones offer and provide set-up and regulatory mechanism similar to a lot of common law jurisdictions. We will be happy to discuss this and assist with potential set-ups in either of these financial freezones.

Stay updated

To learn more about our services and get the latest legal insights from across the Middle East and North Africa region, click on the link below.