- Arbitration

- Banking & Finance

- Capital Markets

- Commercial

- Competition

- Construction & Infrastructure

- Corporate / Mergers & Acquisitions

- Corporate Services

- Corporate Structuring

- Digital & Data

- Dispute Resolution

- Employment & Incentives

- Family Business & Private Wealth

- Innovation, Patents & Industrial Property (3IP)

- Insurance

Find a Lawyer

Book an appointment with us, or search the directory to find the right lawyer for you directly through the app.

Find out more

Level Up: Unlocking Financial Potential In The Middle East

Welcome to this edition of Law Update, where we focus on the ever-evolving landscape of financial services regulation across the region. As the financial markets in the region continue to grow and diversify, this issue provides timely insights into the key regulatory developments shaping banking, investment, insolvency, and emerging technologies.

2025 is set to be a game-changer for the MENA region, with legal and regulatory shifts from 2024 continuing to reshape its economic landscape. Saudi Arabia, the UAE, Egypt, Iraq, Qatar, and Bahrain are all implementing groundbreaking reforms in sustainable financing, investment laws, labor regulations, and dispute resolution. As the region positions itself for deeper global integration, businesses must adapt to a rapidly evolving legal environment.

Our Eyes on 2025 publication provides essential insights and practical guidance on the key legal updates shaping the year ahead—equipping you with the knowledge to stay ahead in this dynamic market.

The leading law firm in the Middle East & North Africa region.

A complete spectrum of legal services across jurisdictions in the Middle East & North Africa.

-

Practices

- All Practices

- Banking & Finance

- Capital Markets

- Commercial

- Competition

- Construction & Infrastructure

- Corporate / Mergers & Acquisitions

- Corporate Services

- Corporate Structuring

-

Sectors

-

Country Groups

-

Client Solutions

Today's news and tomorrow's trends from around the region.

17 offices across the Middle East & North Africa.

Our Services

Back

Back

-

Practices

- All Practices

- Banking & Finance

- Capital Markets

- Commercial

- Competition

- Construction & Infrastructure

- Corporate / Mergers & Acquisitions

- Corporate Services

- Corporate Structuring

- Digital & Data

- Dispute Resolution

- Employment & Incentives

- Family Business & Private Wealth

- Innovation, Patents & Industrial Property (3IP)

- Insurance

- Intellectual Property

- Legislative Drafting

- Private Client Services

- Private Equity

- Private Notary

- Projects

- Real Estate

- Regulatory

- Tax

- Turnaround, Restructuring & Insolvency

- White Collar Crime & Investigations

-

Sectors

-

Country Groups

-

Client Solutions

2024 Corruption Perception Index: Middle Eastern Governments’ Push For Transparency

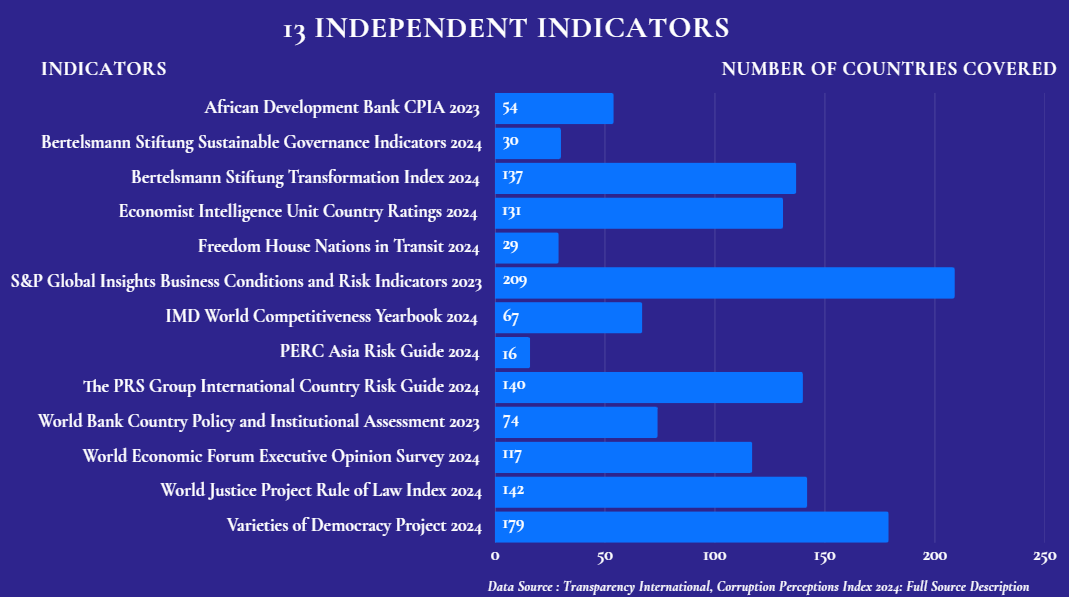

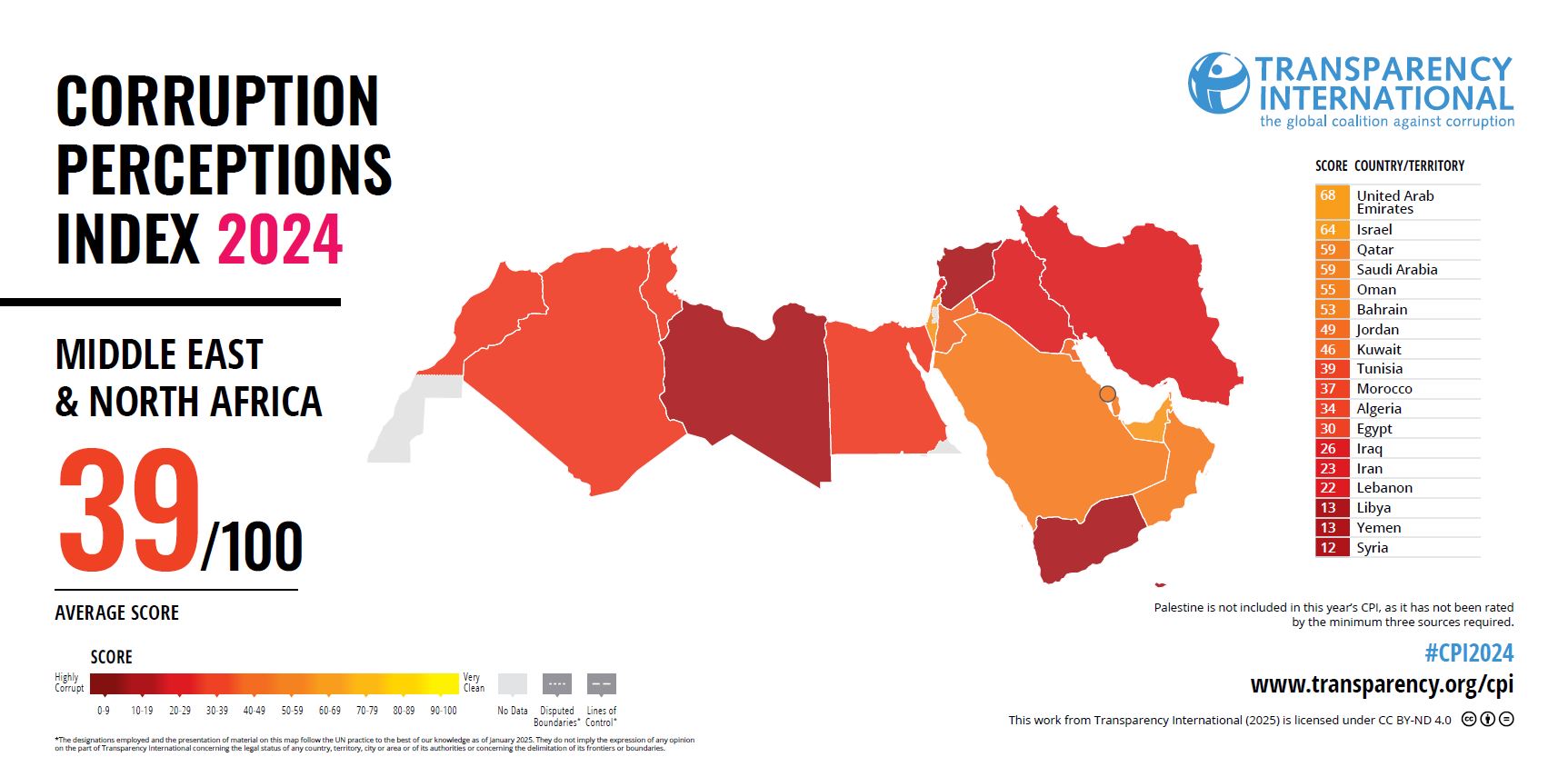

On 11 February 2025, Transparency International, the global watchdog on anti-corruption, released its annual Corruption Perception Index (CPI). The CPI measures perceived levels of public sector corruption according to experts and businesspeople and is widely regarded as an important indicator for foreign direct investment decisions. While the CPI provides a broad market risk assessment and a comparative framework for governance integrity, its methodology has faced criticism, including in the Middle East and North Africa (MENA) region. Whilst Transparency International has also published on the same day its CPI Calculation Criteria, highlighting that each country’s score is based on at least three of 13 independent data sources, the use of proxy indicators may not fully capture local realities, and the reliance on amalgamated data leads to gaps or misalignment with our regional dynamics.

Additionally, the CPI does not offer an interactive tool for companies to assess their operational readiness or gain deeper insights into specific business conditions within these markets. The 2024 CPI report placed a spotlight on governments responses to corruption, highlighting both progress and challenges, with a special focus on corruption impact on climate action and sustainability initiatives.

Bridging the Indicators Disconnect

The chart above illustrates the coverage of the 13 independent indicators used to calculate the 2024 CPI. Upon closer analysis, we note that certain gaps exist in the representation of the MENA region. For example, the Sustainable Governance Indicators (SGI) focus exclusively on 30 OECD and EU member states, leaving MENA countries unrepresented. Similarly, Freedom House’s Nations in Transit 2024 limits its scope to 29 nations in Central Europe and the Newly Independent States, while the Political and Economic Risk Consultancy (PERC) 2024 report concentrates on the Asia-Pacific region.

The World Bank’s Country Policy and Institutional Assessment (CPIA) 2023 covers only 74 countries, and the Rule of Law Index 2024 excludes several key MENA countries such as Qatar, Saudi Arabia, Oman, and Bahrain, despite assessing 142 countries overall. Although the African Development Bank’s CPIA expanded from 37 to 54 African countries, much of the broader of the MENA region remains outside its scope. These gaps present certain limitations in how governance, democracy, and corruption are analysed in the MENA context. Without comprehensive representation, global assessments may overlook important local dynamics and the significant strides made by national authorities in combating corruption. This, in turn, may lead to an incomplete understanding of governance realities in these countries.

For stakeholders and investors, recognizing these nuances is crucial for making well-informed decisions regarding market entry and risk assessment. A more inclusive approach to data collection or preferably a robust tool to assess corruption across all MENA countries with the access to relevant information, which varies from one country to another for various reasons, and measuring the anti-corruption efforts, would help ensure a fuller picture of the regional governance landscape, capturing its challenges and success.

Progress Driven by Local Authorities Investigation and Enforcement Efforts

Be that as it may, this year’s CPI still showcased promising trends for the Middle East indicating significant progress, with several improving their CPI scores. Saudi Arabia and Qatar climbed to 38th place with scores of 59/100, reflecting the impact of targeted enforcement and investigative efforts by local authorities. Jordan made notable gains, improving by 3 points, to a score of 49/100, reaching 59th place, a testament to its growing momentum in combatting corruption compared to previous years.

The United Arab Emirates (UAE) rose from 26th to 23rd place, achieving a score of 68/100, while Bahrain demonstrated sustained improvement, increasing by 17 points since 2017 to reach 53/100. Similarly, Kuwait recorded a 7-point rise, attaining a score of 46/100. These advancements underscore the unwavering commitment of these nations to strengthening their anti-corruption frameworks and governance structures.

Digitalisation and E-Governance : Key Drivers of Progress

Gulf states are adopting e-governance and digitalisation to streamline public administration, reduce human discretion and curb corruption. E-procurement systems have played a pivotal role in minimising bribery and ensuring greater transparency in budget allocations. The digitalization of public services has also empowered citizens with better access to government data, fostering new layers of accountability. The UAE’s Digital Strategy 2025 aims to embed digitalization across all government sectors while promoting inclusivity and accessibility. Saudi Arabia, through Vision 2030 and its National Transformation Programme, is similarly advancing digital governance initiatives to boost efficiency and enhance public trust. However, increased reliance on digital systems also presents new challenges in cybersecurity and data protection which government must navigate carefully. Globally, Denmark retains its top position for the seventh consecutive year, followed closely by Finland, both continuing to set the benchmark. Progress has been made in 32 countries, yet 47 have regressed, including the United States of America, which saw a -4 dip to land at 65/100 in its score from the year 2023.

Navigating A Renewed Landscape: What Businesses Must Know

The 2024 CPI underscores that corruption remains a persistent threat, undermining global efforts to address major challenges. In markets where corruption levels have declined, businesses are expected to reap tangible benefits, including increased investments, economic growth, and improved resource allocation. Transparent and predictable environments attract both domestic and international investors, enabling businesses to innovate, and expand with confidence.

In the Middle East, the local authorities are maximising their anti-corruption efforts. For instance, Saudi Arabia’s National Anti-Corruption Authority (Nazaha) arrested around 1,708 individuals, including government officials, in 2024 alone for offences ranging from bribery, abuse of power to money laundering. Qatar, on its part, enacted the Judicial Enforcement Law No. 4 of 2024, aiming to speed up legal processes and safeguard commercial and financial activities and leading numerous investigations/cases against perpetrators including public officials.

The Road Ahead : Collective Responsibility in Enhancing Integrity

Corruption is a complex and multifaceted issue, with varying indicators across jurisdictions. Common assessment tools are difficult to apply uniformly in the MENA region due to differences in governance systems. However, anti-corruption progress is increasingly seen as essential for attracting Foreign Direct Investment (FDI), with market integrity now a key driver of reform. As a result, businesses operating in the Middle East need to be cognizant of all relevant anti-corruption regulations and have the necessary safeguards and policies in place. Local authorities are increasingly determined to enforce anti-corruption measures, regardless of external developments, such as the recent U.S. Executive Order pausing enforcement of the Foreign Corrupt Practices Act (FCPA) related to bribery and corruption cases. Let’s remind ourselves that whilst the ongoing efforts in the Middle East are already yielding measurable results, with rising foreign direct investment, the establishment of corporate headquarters in prime locations, and an influx of ultra-high-net-worth individuals (UHNWIs), the fight against corruption is far from over. Continuous improvement is necessary to sustain progress, enhance transparency, and secure long term growth.

Key Contacts

Stay updated

To learn more about our services and get the latest legal insights from across the Middle East and North Africa region, click on the link below.