- Arbitration

- Banking & Finance

- Capital Markets

- Commercial

- Competition

- Construction & Infrastructure

- Corporate / Mergers & Acquisitions

- Corporate Services

- Corporate Structuring

- Digital & Data

- Dispute Resolution

- Employment & Incentives

- Family Business & Private Wealth

- Innovation, Patents & Industrial Property (3IP)

- Insurance

Find a Lawyer

Book an appointment with us, or search the directory to find the right lawyer for you directly through the app.

Find out more

Level Up: Unlocking Financial Potential In The Middle East

Welcome to this edition of Law Update, where we focus on the ever-evolving landscape of financial services regulation across the region. As the financial markets in the region continue to grow and diversify, this issue provides timely insights into the key regulatory developments shaping banking, investment, insolvency, and emerging technologies.

2025 is set to be a game-changer for the MENA region, with legal and regulatory shifts from 2024 continuing to reshape its economic landscape. Saudi Arabia, the UAE, Egypt, Iraq, Qatar, and Bahrain are all implementing groundbreaking reforms in sustainable financing, investment laws, labor regulations, and dispute resolution. As the region positions itself for deeper global integration, businesses must adapt to a rapidly evolving legal environment.

Our Eyes on 2025 publication provides essential insights and practical guidance on the key legal updates shaping the year ahead—equipping you with the knowledge to stay ahead in this dynamic market.

The leading law firm in the Middle East & North Africa region.

A complete spectrum of legal services across jurisdictions in the Middle East & North Africa.

-

Practices

- All Practices

- Banking & Finance

- Capital Markets

- Commercial

- Competition

- Construction & Infrastructure

- Corporate / Mergers & Acquisitions

- Corporate Services

- Corporate Structuring

-

Sectors

-

Country Groups

-

Client Solutions

Today's news and tomorrow's trends from around the region.

17 offices across the Middle East & North Africa.

Our Services

Back

Back

-

Practices

- All Practices

- Banking & Finance

- Capital Markets

- Commercial

- Competition

- Construction & Infrastructure

- Corporate / Mergers & Acquisitions

- Corporate Services

- Corporate Structuring

- Digital & Data

- Dispute Resolution

- Employment & Incentives

- Family Business & Private Wealth

- Innovation, Patents & Industrial Property (3IP)

- Insurance

- Intellectual Property

- Legislative Drafting

- Private Client Services

- Private Equity

- Private Notary

- Projects

- Real Estate

- Regulatory

- Tax

- Turnaround, Restructuring & Insolvency

- White Collar Crime & Investigations

-

Sectors

-

Country Groups

-

Client Solutions

Expansion of the UAE national Salary Support Scheme in Private Sector: Key information

The UAE government recently announced a decision to further expand the salary support under the UAE national Salary Support Scheme. The scheme is aiming to boost the government’s campaign to integrate UAE nationals into the private and banking sectors by providing allowances, bonuses, and other monetary incentives to UAE national employees. This is in line with the government’s aim to increase the proportion of UAE nationals in the private sector to at least 10% by 2026.

Scope of the new support plan

The UAE government has announced that the decision covers all UAE national employees in the private sector irrespective of the date of their recruitment, including those who were hired both before and after the introduction of the NAFIS programme (which is the federal government programme aimed at increasing UAE nationals’ employment in the private sector). According to the government’s announcement, financial support has been made available so that monthly allowances of up to a maximum of AED 7,000 for holders of a bachelor’s degree, AED 6,000 for diploma holders, and AED 5,000 for secondary level diploma holders or less can be earned, provided that the employee’s monthly basic salary is less than AED 30,000.

Application

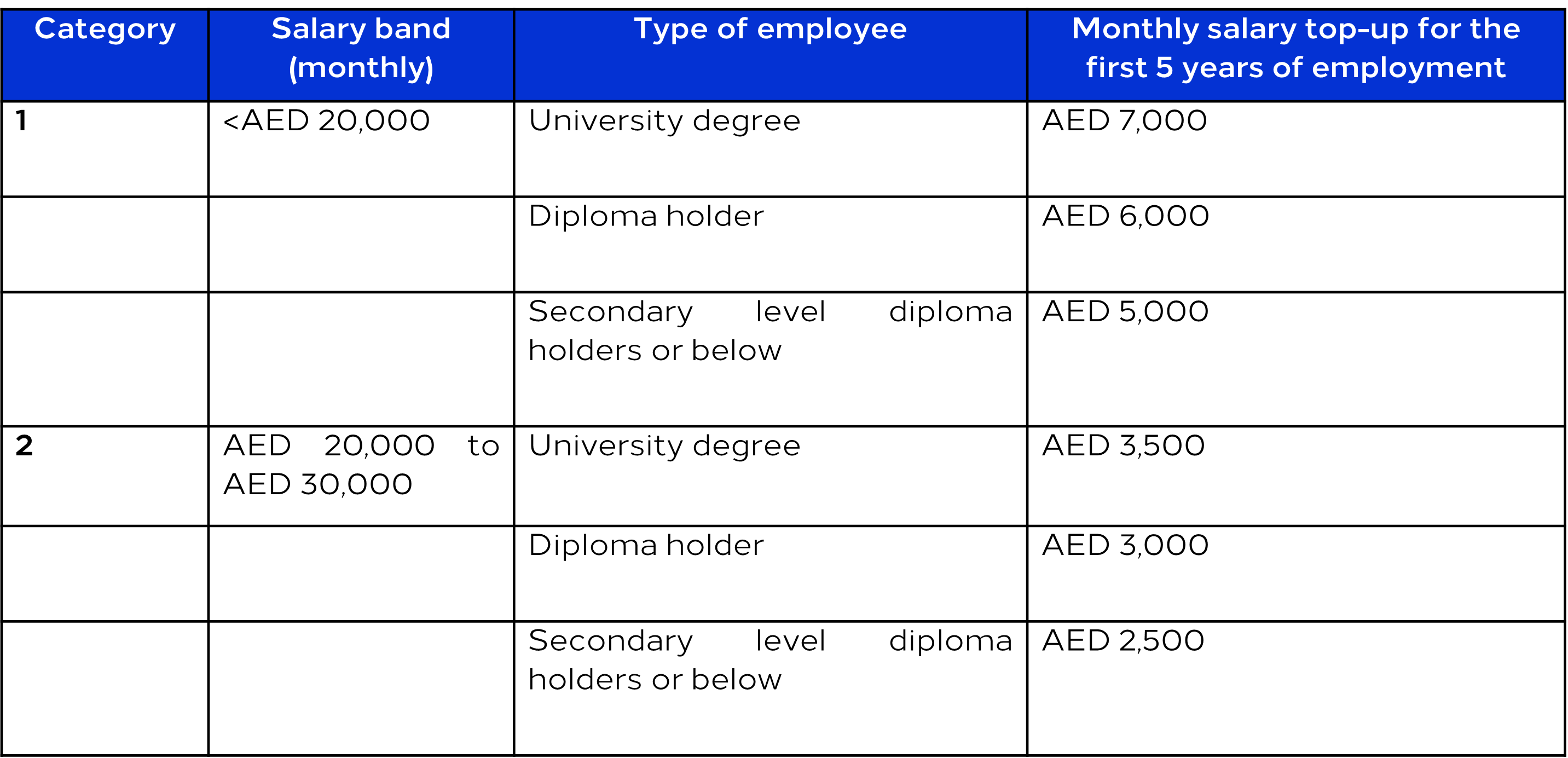

There are two categories: employees with monthly salaries below AED 20,000, and employees with salaries of AED 20,000 to AED 30,000 as follows:

The salary top-up is calculated based on the difference between the employee’s current monthly salary and the designated salary for each category, provided that it should not exceed the maximum of AED 20,000 or AED 30,000 per month, as applicable to their category.

So, if a university degree holder’s monthly salary is AED 16,000, the salary top-up is AED 4,000 and not AED 7,000 (16,000+4,000 = AED 20,000 which is the maximum cap for those earning less than AED 20,000 per month).

The minimum salary top-up is AED 1,000.

Other support

UAE nationals working in the private sector will also be entitled to an allowance of AED 600 for each child, provided that their total monthly salary does not exceed AED 50,000. The support will be provided for a maximum of four (4) children for a period of five (5) years.

The decision also provides a temporary financial aid for UAE nationals who lose their job due to circumstances beyond their control. The temporary support period has been extended to twelve (12) months, and the benefit period should not exceed six (6) consecutive months.

Failure to meet the Emiratisation percentage

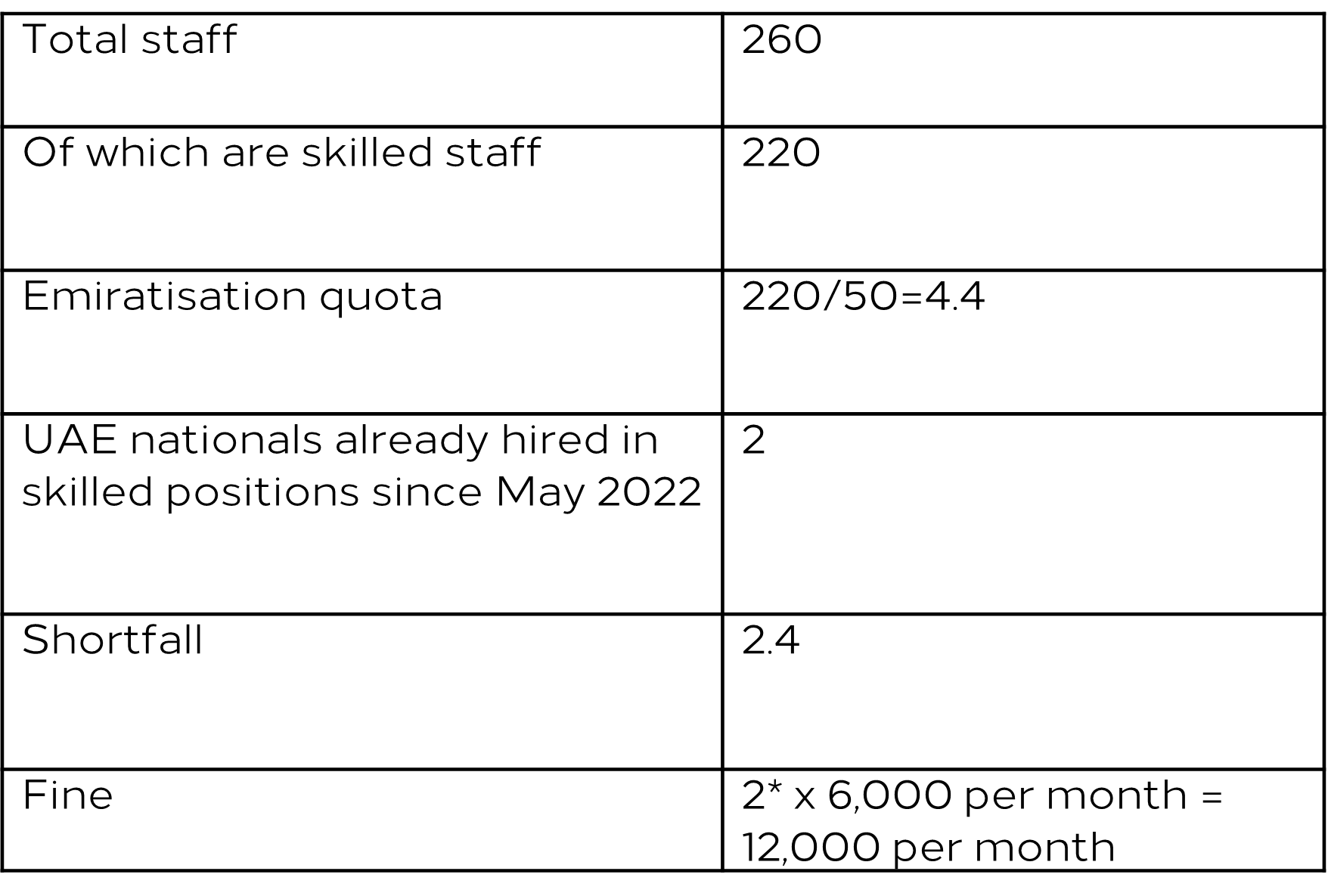

From January 2023, private sector companies with more than 50 skilled employees that do not reach the Emiratisation percentage of 2% annually will be subject to fines. MOHRE have indicated that the Emiratisation percentage is retrospective, i.e. if an employer does not meet the Emiratisation target by 1 January 2023 then a fine will be imposed for 2022.

Companies who do not meet the Emiratisation target will be subject to a fine of AED 6,000 (“Contribution”) per month per quota positon not filled by a UAE national.

The Emiratisation target is cumulative, so in year 2022 the company should have 2% Emiratisation, in year 2023 it should be 4% and so on.

Worked example

It is acceptable for an employer’s percentage of UAE nationals to temporarily fall below the required target if the period is no more than 2 months.

The Contribution is payable at the beginning of the following year in one lump sum payment.

Penalties

The UAE Cabinet approved the Cabinet Resolution no. (95) of 2022 Regarding Penalties and Violations Relating to the Emirati Cadres Competitiveness Council Initiatives and Programs (the “Resolution”).

The Resolution implemented various penalties in the event that companies or the beneficiary UAE national employees submit incorrect documents or data to obtain the services or benefits of NAFIS, or for the purposes of evasion or circumvention of the Emiratisation system. Some of the penalties include:

- a fine not less than AED 20,000 and not more than AED 100,000; and

- stopping the support to the beneficiary employee, and recovering any amounts disbursed to them.

Employers should ensure that they familiarise themselves with these new requirements, so that their UAE national employees are appropriately provided for as required under the law.

If you have any queries on this topic, please do not hesitate to reach out to us.

Key Contacts

Stay updated

To learn more about our services and get the latest legal insights from across the Middle East and North Africa region, click on the link below.