- Arbitration

- Banking & Finance

- Capital Markets

- Commercial

- Competition

- Construction & Infrastructure

- Corporate / Mergers & Acquisitions

- Corporate Services

- Corporate Structuring

- Digital & Data

- Dispute Resolution

- Employment & Incentives

- Family Business & Private Wealth

- Innovation, Patents & Industrial Property (3IP)

- Insurance

Find a Lawyer

Book an appointment with us, or search the directory to find the right lawyer for you directly through the app.

Find out more

Level Up: Unlocking Financial Potential In The Middle East

Welcome to this edition of Law Update, where we focus on the ever-evolving landscape of financial services regulation across the region. As the financial markets in the region continue to grow and diversify, this issue provides timely insights into the key regulatory developments shaping banking, investment, insolvency, and emerging technologies.

2025 is set to be a game-changer for the MENA region, with legal and regulatory shifts from 2024 continuing to reshape its economic landscape. Saudi Arabia, the UAE, Egypt, Iraq, Qatar, and Bahrain are all implementing groundbreaking reforms in sustainable financing, investment laws, labor regulations, and dispute resolution. As the region positions itself for deeper global integration, businesses must adapt to a rapidly evolving legal environment.

Our Eyes on 2025 publication provides essential insights and practical guidance on the key legal updates shaping the year ahead—equipping you with the knowledge to stay ahead in this dynamic market.

The leading law firm in the Middle East & North Africa region.

A complete spectrum of legal services across jurisdictions in the Middle East & North Africa.

-

Practices

- All Practices

- Banking & Finance

- Capital Markets

- Commercial

- Competition

- Construction & Infrastructure

- Corporate / Mergers & Acquisitions

- Corporate Services

- Corporate Structuring

-

Sectors

-

Country Groups

-

Client Solutions

Today's news and tomorrow's trends from around the region.

17 offices across the Middle East & North Africa.

Our Services

Back

Back

-

Practices

- All Practices

- Banking & Finance

- Capital Markets

- Commercial

- Competition

- Construction & Infrastructure

- Corporate / Mergers & Acquisitions

- Corporate Services

- Corporate Structuring

- Digital & Data

- Dispute Resolution

- Employment & Incentives

- Family Business & Private Wealth

- Innovation, Patents & Industrial Property (3IP)

- Insurance

- Intellectual Property

- Legislative Drafting

- Private Client Services

- Private Equity

- Private Notary

- Projects

- Real Estate

- Regulatory

- Tax

- Turnaround, Restructuring & Insolvency

- White Collar Crime & Investigations

-

Sectors

-

Country Groups

-

Client Solutions

UAE Federal Corporate Tax Law – Impact on the Pharmaceutical Industry

The Ministry of Finance in the UAE recently published the much-awaited Federal Decree-Law No. 47 of 2022 on the Taxation of Corporations and Businesses (“CT Law“). The CT Law will apply to financial years commencing on or after 1 June 2023.

All businesses in the UAE, including in free zones and foreign businesses with permanent establishments, or that derive UAE sourced income, or have a nexus in the UAE will be impact by the CT Law.

The CT Law introduces corporation tax (“CT”) at a rate of 0% on taxable income up to AED 375,000 and 9% on taxable income above AED 375,000.

Whilst not prescribed in the CT Law, a different CT rate will apply to multinational corporations that fall within the scope of OECD’s BEPS Pillar Two project (i.e. where the group has consolidated global revenues in excess of EUR 750 million (approximately AED 3.15 billion)).

Qualifying free zone persons will be subject to 0% CT on qualifying income and 9% CT on non-qualifying income. The CT Law prescribes conditions that free zone entities must satisfy in order to be treated as qualifying free zone persons.

The CT Law requires that all related party transactions should be undertaken on arm’s length terms and establishes rules for determining arm’s length standard, as well as sets out the definitions for “related parties”, “control” and “connected persons”.

What does this mean for the pharmaceutical industry?

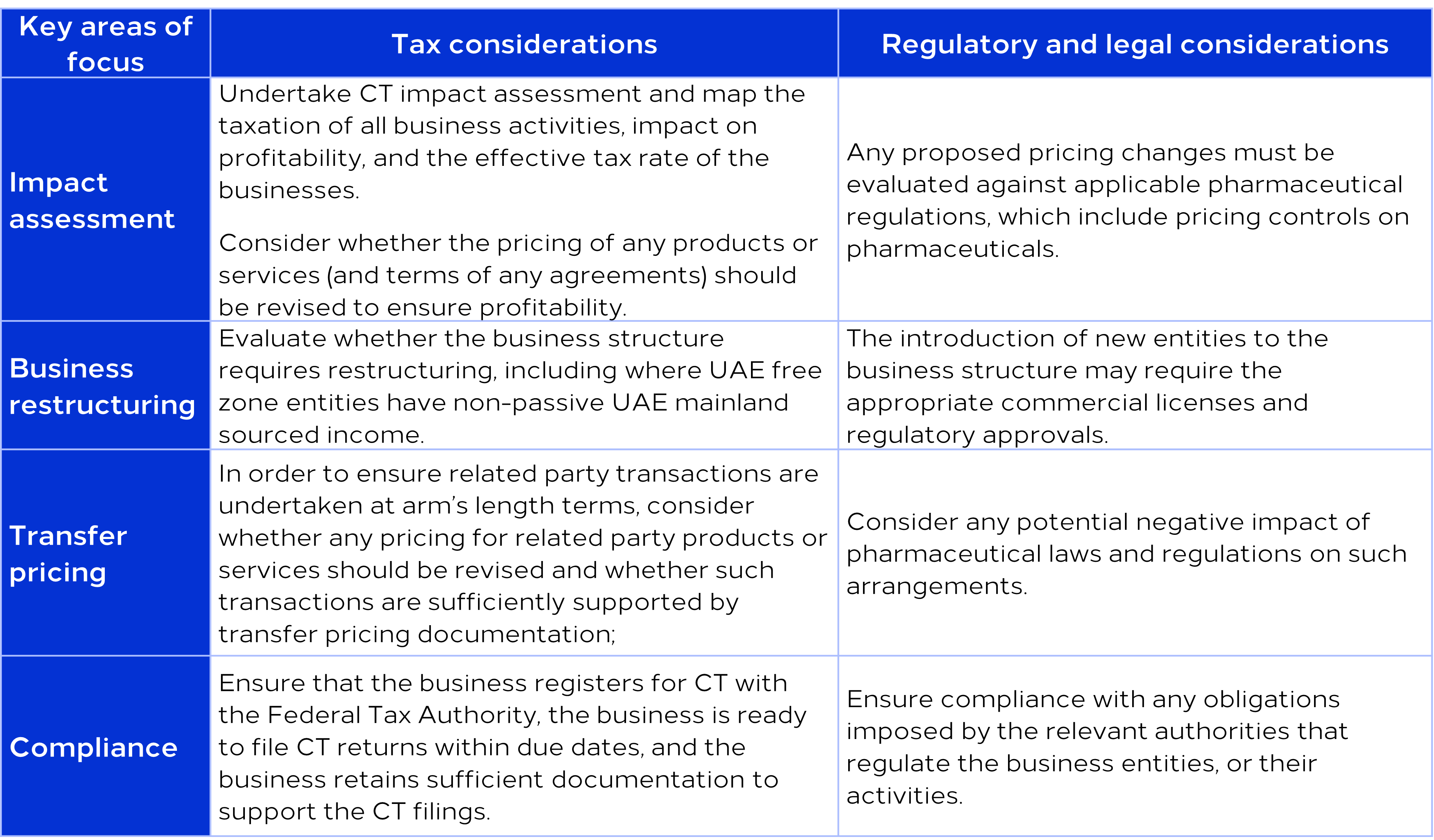

It is crucial for all UAE businesses to understand the CT rules and assess its implications in order to be compliant and ensure tax efficiency. Based on our experience, some of the key areas that pharmaceutical companies need to focus on to implement CT may be as follows:

Legal and regulatory considerations for life sciences

As business models change, and regulations in the region become more elaborate, tax planning has become more complex. When implementing CT in heavily regulated industries, such as the life sciences industry, any changes to the business model should be evaluated against the laws and regulations governing the industry to avoid accidentally running afoul of such things as product pricing control and limitations on entities that can conduct pharmaceutical sales.

Whether pharmaceutical companies maintain their own trading entities in the region, use third party distributors, have established a representative office, or entered into toll manufacturing arrangements, such companies will be impacted by the introduction of CT.

Many pharmaceutical companies rely on third-party distributors, however, CT exposure may be triggered depending on how the distribution arrangement is structured. Further, where scientific offices / marketing firms (“SO”) are, strictly speaking, restricted to promotional activities, we are aware that some SO’s operate beyond these restrictions, potentially creating CT exposure.

How can we help?

We would be delighted to provide more information about this development, or support your entity in adapting to the new CT framework from a tax, legal, and regulatory perspective. Please let us know if we can assist by contacting healthcare@tamimi.com or by contacting one of the authors of this alert.

Key Contacts

Stay updated

To learn more about our services and get the latest legal insights from across the Middle East and North Africa region, click on the link below.